Last Wednesday, the head of the United States Federal Reserve, Jerome Powell, announced a 50-point base rate suba along with a more restrictive monetary policy program, reducing the positions in its treasuries balance and mortgage-backed securities in June at 47.5 billion and reaching a monthly reduction level of 95 billion in three months. He also understood that, at the time, the committee does not consider subas of 75 basic points in the next meetings. Initially, this generated tranquillity among investors because, while not so aggressive, Fed would be aiming to reduce inflation without necessarily generating a recession. Indices have risen strongly and long-rate income has declined.

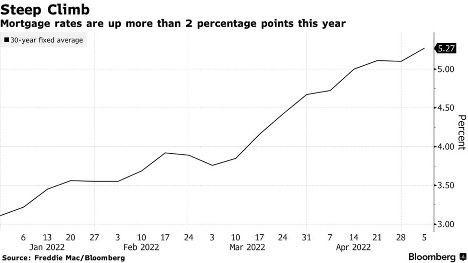

Two days after this decision, the indices have already lost all the gains they had accumulated and the rate at 10 years continuous rising, surpassing 3%. The mortgage rate at 30 years is also giving a lot to talk about since the year started at 3.1% and is currently at 5.27%. The Bloomberg chart below shows the move this year. This dynamic left many potential buyers out of the market, as monthly mortgage payments became too high.

The combination of these factors generates a lot of uncertainty among investors, leading them to think that maybe there are no more options in the Fed toolbox to save the economy from a recession.

The combination of these factors generates a lot of uncertainty among investors, leading them to think that maybe there are no more options in the Fed toolbox to save the economy from a recession.

Comments