```

When a financial advisor, portfolio manager, or any individual decides to invest in equity instruments, such as YPF stocks, they are exposing themselves to two types of risk: Systematic Risk + Unsystematic Risk

The unsystematic risk, also known as diversifiable risk or company-specific risk, is inherent to the company's performance, does not affect the results of other companies, and depends exclusively on internal factors such as management style and philosophy, success in research and development, etc.

On the other hand, the systematic risk, also known as non-diversifiable risk, is attributed to the general economic conditions, as a result of economic cycles, inflation, interest rates, etc., affecting (to varying degrees) all companies and cannot be eliminated.

Diversifying the investment portfolio among different assets allows reducing exposure to company-specific factors (unsystematic risk) in such a way that the portfolio's volatility will gradually decrease. However, when common sources of risk (systematic risk) affect all companies, not even a broad diversification can eliminate this risk, and the portfolio's volatility reaches the lowest possible value but never zero.

That said, it is of great interest to know what is the exposure of a particular asset to market variations and ultimately what is the exposure of the entire portfolio to market volatility itself.

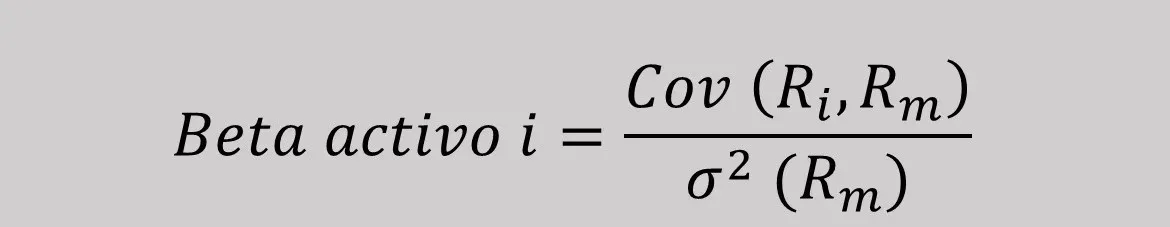

The indicator that allows us to know the fluctuation of an asset's value concerning market fluctuations is commonly known as "Beta" and is obtained by performing the following operation:

That is, it results from the ratio between the covariance of the market return as a whole and the return of asset i, over the variance of the market return. The beta value has a wide range of variation, and it can be both negative and positive:

· If an asset's beta is equal to 1, it implies that it moves in the same direction and with the same magnitude as the market as a whole (the beta of a market index is 1).

· If an asset's beta is greater than 1, it means it follows the market behavior but is more volatile, and it will be higher the greater its beta.

· Conversely, when the beta value is negative, it indicates that the asset moves in the opposite direction to the market and will be more volatile (in the opposite direction) the lower its beta (more negative).

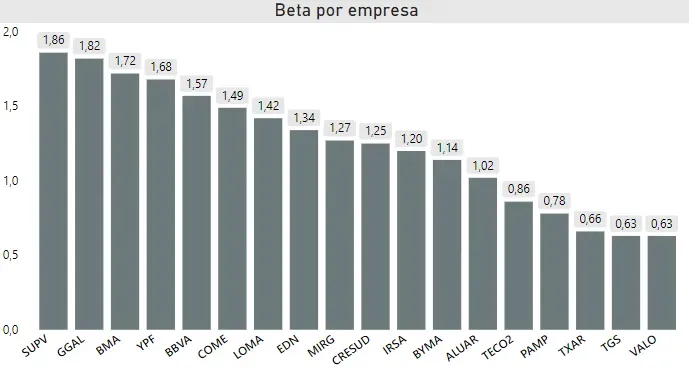

The following graph shows the beta of companies belonging to the leading panel of Merval, using monthly data from the last five years

Own elaboration based on BYMA

It is clear that companies linked to the financial sector showed higher volatility, while those linked to the industrial sector (aluminum, steel) and telecommunications remained more stable than the market but always fluctuated in the same direction.

This implies that, assuming parameters remain stable, for every 1% change in the market, Supervielle would vary 1.86%, Galicia 1.82%, and Macro 1.72%, while Ternium and TGS would change by 0.66% and 0.63% respectively.

Although this is not a purchase recommendation, one of the most important factors when investing is the level of risk the investor is willing to take, and if we have a well-diversified portfolio, this risk will be reflected in its beta (concerning market changes).

Thus, for instance, taking the data from the graph and assuming we want to design a portfolio composed of three leading companies from different sectors but with the lowest level of exposure to market variations, this could be composed in equal proportions by: CRESUD (Agricultural), TGS (Energy), and Aluar (industrial), which would result in a beta of 0.96, a level of volatility slightly lower than market volatility.

```

Comments