It follows in the discussion on what is the right way to measure hyperinflation, and when it states that an economy is in this process.There are some main references, the first derivative of the famous “paper” of economist Phillip Cagan (1956) "The Monetary Dynamics of Hyperinflation". On statistical studies carried out with the inflationary dynamics of European countries since the early twentieth century, in a context of two world wars and cruel inflationary processes such as those that lived in Germany, Hungary etc.This old study establishes that a country would be in hyperinflation, when the inflation rate of its economy exceeds 50% monthly, for a period greater than 12 months.On the other hand, we have the International Financial and Accounting Information Standards (International Financial Reporting Standards/ IFRS), issued in recent time and accepted by more than 166 countries, contain a chapter or standard for financial and accounting information in hyperinflationary economies, which synthesise modern criteria since 2001 to define the conditions of hyperinflation and its applicability to corporate financial states.

- Regulation 29 describes quantitative characteristics of hyperinflation, including an accumulated inflation rate for 3 years exceeding 100%.

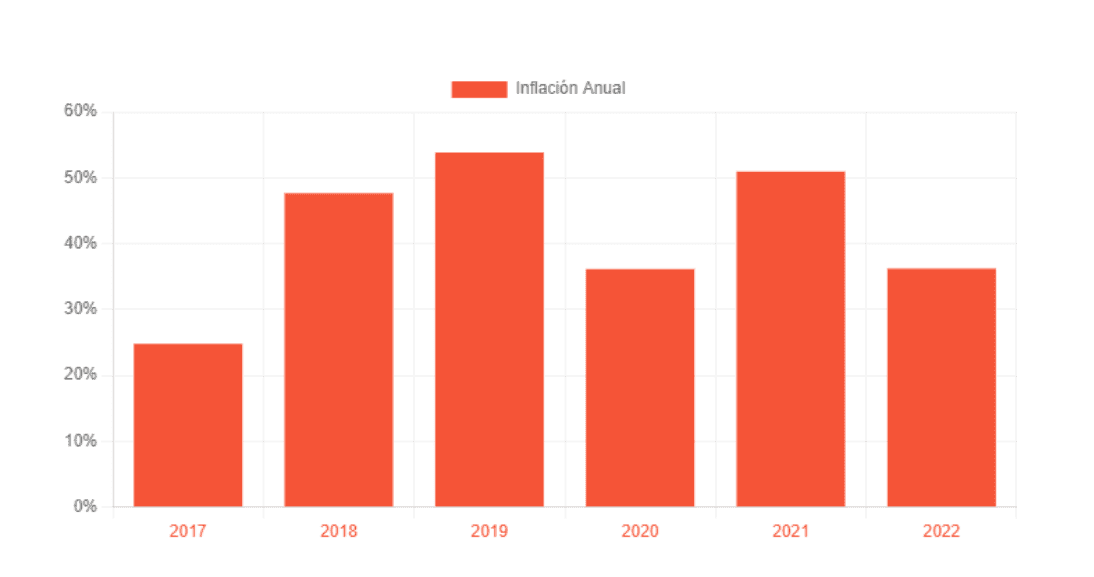

- All the qualitative and quantitative factors contained in the norm are present in the Argentine economy, as the relevant inflation rates show an accumulated rate in the last 3 years exceeding 100%, providing at first glance sufficient evidence of that the economy of Argentina (as defined in IAS 29) is hyperinflationary (Deloitte).

- Both price indices, the national wholesale price index (national wholesale Price irndex WPI), and the consumer price index CPI (the measure typically used to evaluate inflation) exceed metric or standard, accumulating 141% in the annual base, and 146,62 % in the last 36 months, more than 3 digits.

Among the qualitative aspects we also have:

Among the qualitative aspects we also have:- The general population prefers to maintain its wealth in the form of non-monetary or foreign assets, showing contempt for the medium and long-term local currency.

- The local currency quantities obtained are inverted or converted immediately to maintain adquisitive capacity.

- The general population takes account of the monetary quantities in terms of another stable foreign currency, namely for rent, contracts, purchase of property, vehicles, telephones, goods and others.

- Prices start to be set in another currency as the local currency loses its value reserve condition, and begin to cease publishing in windows, shops or displays.

- Credit sales start to disappear, remain for very short periods at the high cost of opportunity, and currency decay.

- Interest rates, wages and prices begin to be indexed dynamically to the evolution of a price index, reinforcing the problem.

- The risk is increased, and the international reserves that are the support of the local currency begin to deplete.

Comments