The Argentine country risk plummets after good news from the market

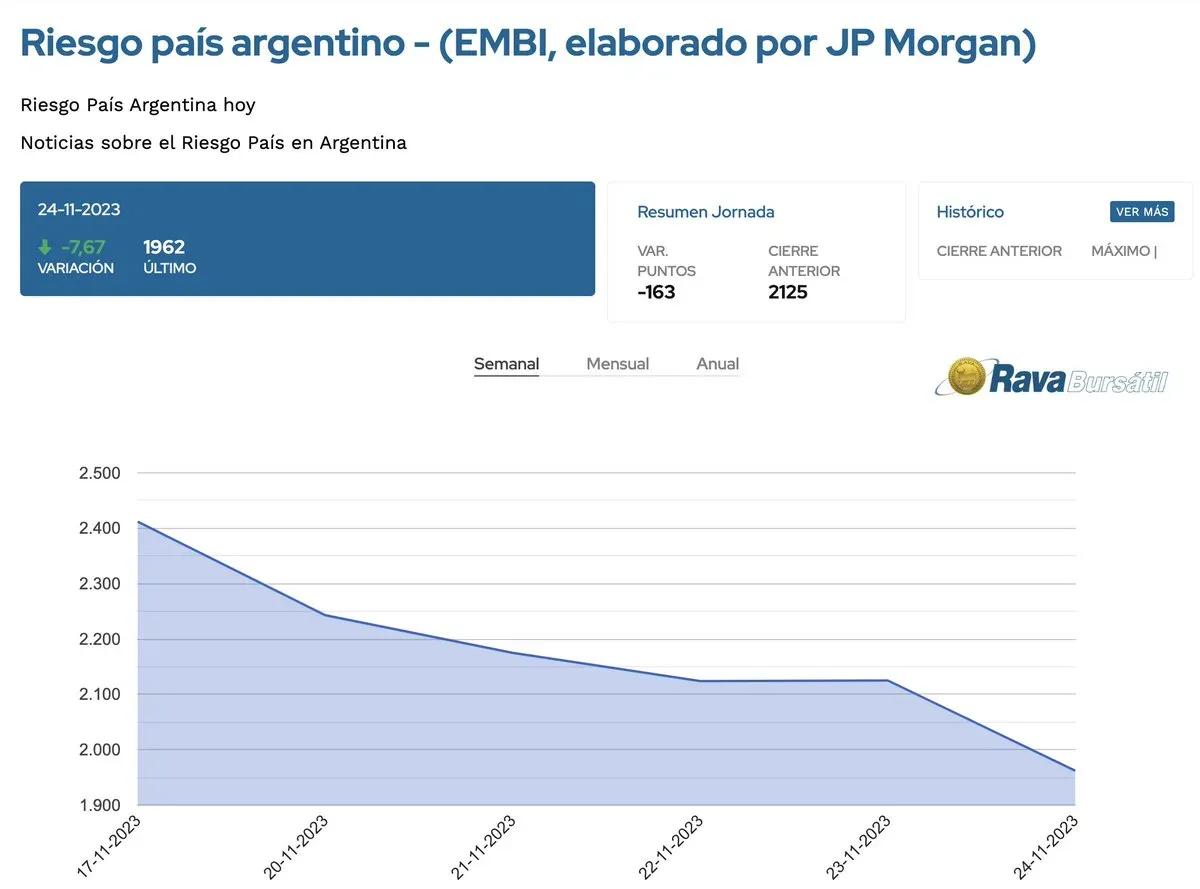

In the last 24 hours, the Argentine country risk has experienced a remarkable decline, falling to 1,089 points according to the EMBI index compiled by JP Morgan. This shift came after an optimistic message from analyst Scott Bessent, prompting a positive reaction in Argentine ADRs and bonds, which saw increases of up to 24%. This phenomenon invites reflection on the implications of this reduction and its context within the national economy.

📉 Current outlook

The country risk is an indicator that measures the likelihood of a country defaulting on its debt obligations. In Argentina's case, the recent drop of 370 points is a relief in a prolonged context of economic uncertainty, where inflation exceeds 100% annually and the economy has been in recession. A high country risk implies high financing costs and distrust in the government's ability to manage its debt. The improvement in this indicator could be interpreted as a sign of renewed confidence in the economic policy of the new government and its ability to manage public finances more effectively.

However, it is crucial not to fall into excessive optimism. Stability is fragile, and the country must face deep structural challenges that have contributed to the persistent economic crisis. Fiscal policy, currency regulations, and the financial system are aspects that require immediate attention.

🌍 International comparison

To better understand the situation, it is useful to compare Argentina with other countries that have faced debt crises. For example, Greece in 2010 saw a dramatic increase in its country risk, reaching unsustainable levels. The austerity measures implemented by the Greek government, along with structural reforms and international support, allowed for eventual stabilization and economic recovery.

Another relevant case is Ukraine, which, after the 2014 crisis, saw a significant increase in its country risk due to political instability and internal conflicts. However, through reforms and a financing agreement with the International Monetary Fund (IMF), it managed to reduce its country risk in the following years.

Argentina finds itself at a similar crossroads; the implementation of coherent and sustainable economic policies is essential to avoid a return to unsustainable risk levels. History shows that recovery is not immediate and requires a long-term commitment from all political and social actors.

⚠️ Economic implications

The drop in country risk has several important implications. First, a reduction in country risk can create a more favorable environment for foreign investment. Investors tend to seek markets where risk is considered low, which in turn can facilitate the entry of fresh capital into the local economy.

However, it is vital to remember that this phenomenon does not guarantee sustainable growth. Improvement in country risk must be accompanied by structural reforms that strengthen institutions and promote a climate of trust. Without strong institutions, there is no trust. Without trust, there is no investment. This translates into the need to work on government transparency, respect for the legal framework, and the fight against corruption.

Moreover, the sustainability of public debt is another aspect that should not be overlooked. A reduction in country risk could also lead to an increase in debt issuance. However, if this debt is not used to foster productive growth, it can become an unsustainable burden in the future.

🔍 Recommendations for the future

To maintain the positive trend in country risk, clear and decisive actions are required. First, it is essential for the government to establish a solid fiscal plan that contemplates a balance in public accounts, ensuring that spending does not consistently exceed revenues. Fiscal balance is not a whim. It is a prerequisite for growth.

It is also suggested to promote dialogue among the different sectors of the economy, including workers, entrepreneurs, and the government. Such interaction can help generate consensus that allows for necessary reforms without provoking social tensions.

Finally, it is crucial to maintain a prudent monetary policy that not only seeks to control inflation but also considers the stability of the financial system. This will help avoid episodes of volatility that could negatively affect the perception of country risk.

In conclusion, the recent drop in Argentina's country risk represents an opportunity for the country, but it is essential that it be used as a starting point to implement structural reforms. Without a clear direction and concrete actions, progress may be fleeting. Argentina does not need more patches. It needs direction.

Comments