The country risk is a crucial indicator that reflects investors' perception of a country's economic and political stability. In the Argentine context, this index has reached alarming levels, surpassing 500 basis points, according to the EMBI index developed by JP Morgan. This situation raises the central question: what factors have led Argentina to this critical point and what are the implications for its economic future? Understanding this issue is vital not only for evaluating the investment climate, but also for outlining strategies that allow for sustainable development.

📊 Current Outlook

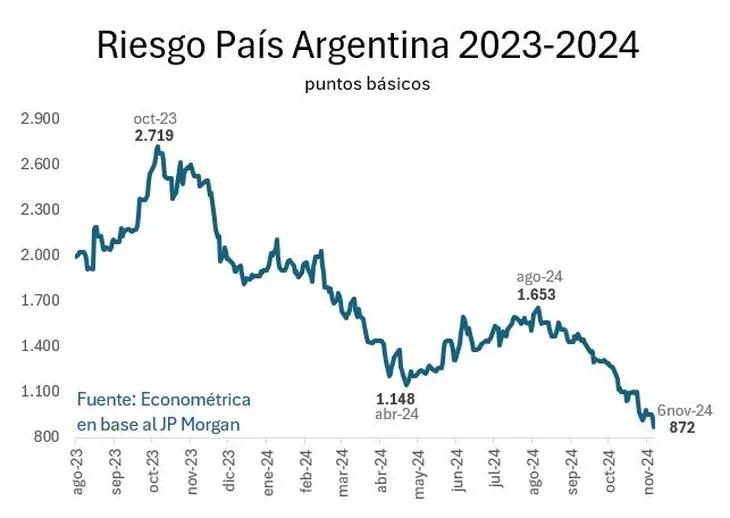

In recent weeks, Argentina's country risk has shown considerable volatility, reaching figures close to 513 basis points. According to data from the Central Bank of the Argentine Republic (BCRA), both the official and blue dollar rates have experienced significant increases, reflecting a growing distrust in the local economy. This context is exacerbated by an annual inflation rate that exceeds 100%, according to INDEC, which directly affects the purchasing power of citizens and limits investment opportunities. The combination of these factors has created an environment where uncertainty prevails, thus complicating any long-term strategy.

📉 Analysis of Causes and Factors

The causes of the high country risk in Argentina are multiple and complex. First, the country's recent history is marked by recurring economic crises that have eroded trust in institutions. Since 2001, when Argentina declared itself in default, to the economic crisis caused by the pandemic in 2020, each episode has left deep scars on the national economy. The lack of sustainable fiscal policies and the growing fiscal deficit are other critical factors; in 2023, it is estimated that the fiscal deficit could reach up to 5% of GDP. Furthermore, reliance on external financing and high inflation create a vicious cycle that further fuels the risk perceived by investors.

🌍 International Comparison and Global Impact

When comparing Argentina with other emerging countries, it is evident that its country risk is significantly higher. For example, Brazil has a country risk close to 300 basis points, indicating a more favorable perception from investors. Historically, countries like Chile have managed similar situations through structural reforms and a focus on responsible fiscal policies. In 2019, Chile implemented a series of reforms aimed at improving its institutional framework and increasing government transparency; as a result, its country risk decreased significantly. This contrast highlights how political and economic decisions can drastically influence international perception.

⚠️ Implications and Consequences

The implications of high country risk are deep and multifaceted. For Argentine citizens, this translates to a decrease in purchasing power due to uncontrolled inflation and the constant rising cost of living. For local businesses, access to financing becomes more complicated and costly; according to a report from the BCRA, interest rates have reached historical levels of 80% annually for commercial loans. At the macroeconomic level, this situation could lead to a slowdown in economic growth and even prolonged stagnation if effective corrective measures are not implemented.

🔮 Strategic Perspective and Future Outlook

Looking ahead, Argentina faces several significant risks if it does not address its structural problems. The political uncertainty surrounding the upcoming elections could further exacerbate the country risk if clear signs of economic stability are not perceived. However, there are opportunities if strategic reforms focusing on strengthening institutions and improving fiscal sustainability are adopted. Investing in sustainable infrastructure could be a way to attract foreign capital and spur long-term economic growth. It is imperative that political leaders recognize that “fiscal balance is not a whim; it is a prerequisite for growth.”

In conclusion, the analysis of Argentina's country risk reveals not only immediate challenges but also opportunities to restructure its economy towards a more stable and prosperous future. The key will be to adopt consistent measures that restore confidence both within and outside the country.

Comments