The notable drop in country risk following the elections

The country risk of Argentina has experienced a notable drop in recent days, closing at 708 basis points, a decrease of nearly 400 points from its recent high. This decline has occurred in the context of significant political changes following the electoral victory of Javier Milei, which has generated renewed interest in investment and the country’s economy. However, this phenomenon raises questions about the sustainability of this trend and the underlying realities that support it.

📉 Current outlook

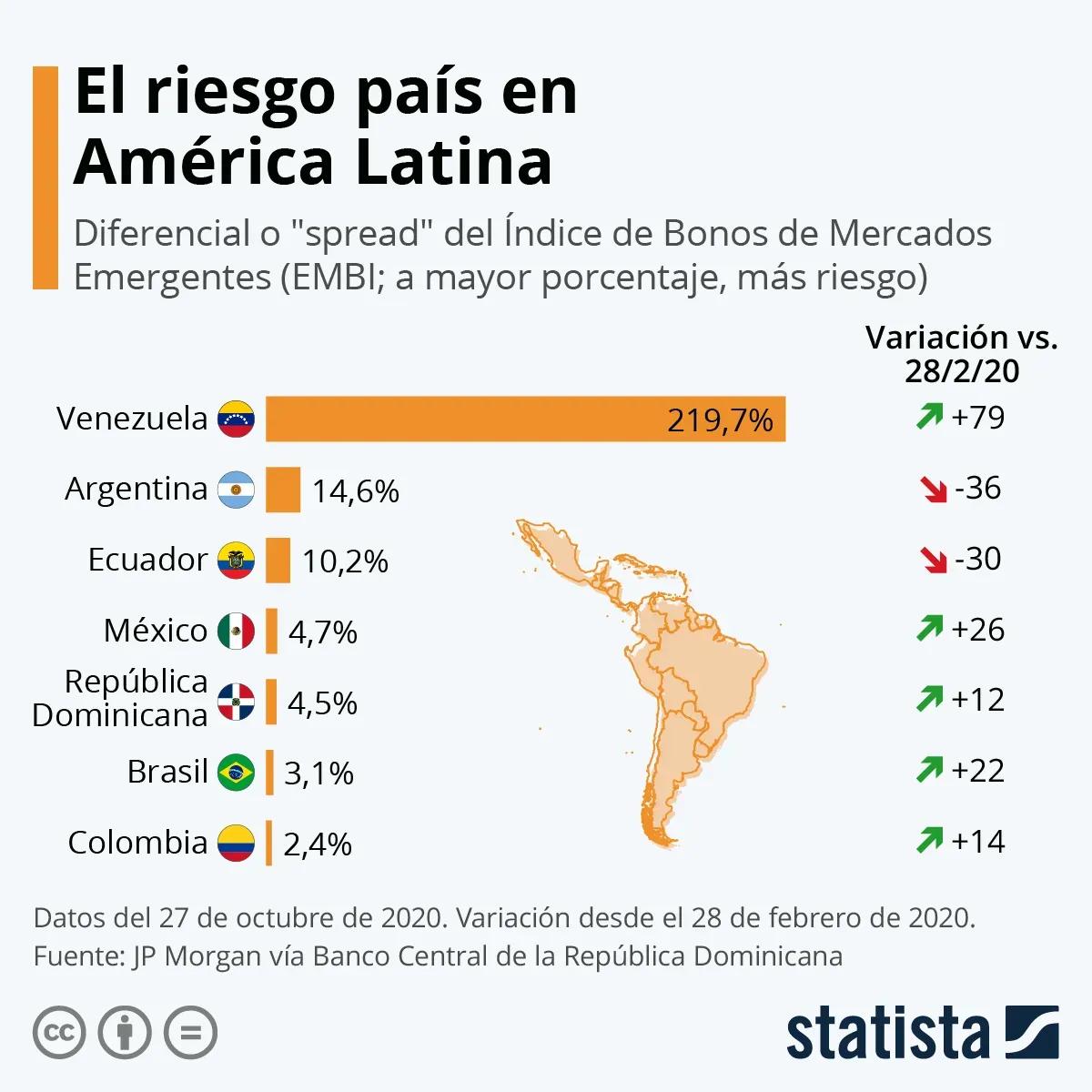

In the current context, country risk has become a crucial thermometer for measuring investor confidence in the Argentine economy. The recent drop in country risk partly reflects a positive response to the arrival of a new government that promises structural reforms. However, it is essential to approach the issue with caution. Despite the decrease in basis points, the current level of 708 remains significantly high compared to other countries in the region. Political uncertainty, along with the structural challenges of the economy, raises the need for a deeper analysis of whether this trend is sustainable in the long term.

The immediate effects of this drop are clear: an improvement in investment expectations, a possible increase in capital inflows, and a moderation in interest rates. However, it is essential to remember that economic stability cannot be guaranteed solely by political changes. Inflation, which remains one of the main concerns, and external debt continue to be critical factors that must be urgently addressed.

🌍 International comparison

When observing the international landscape, it is interesting to compare Argentina's situation with that of other countries that have gone through similar crises. For example, Greece in the 2010s experienced a dramatic increase in its country risk due to debt issues and a lack of confidence in its institutions. However, after implementing fiscal and structural reforms, it significantly reduced its country risk, although not without facing social and political challenges along the way.

On the other hand, Ukraine, amidst a military conflict, has seen extreme fluctuations in its country risk, which has remained high despite international assistance. This demonstrates that economic stability is not just a matter of domestic policy but also of international context.

Argentina, like these countries, faces the pressure of balancing reforms with the need to maintain social cohesion. History has shown that political rhetoric can temporarily inflate investor confidence, but effective policy implementation is what will truly determine the future direction.

⚠️ Economic and social implications

The decline in country risk has multiple implications. From an economic perspective, a decrease in risk can facilitate access to financing under more favorable conditions, which is vital for growth. However, it is important to consider that this change may also bring inflationary pressures if not accompanied by effective control of the money supply.

Socially, the expectation of an economic improvement could generate an increase in public confidence. However, if the promised reforms are not implemented effectively, or if their costs disproportionately burden the most vulnerable sectors, social discontent could grow. Therefore, the sustainability of the reduction in country risk is intrinsically linked to the new government's ability to effectively manage social and economic expectations.

🔍 What is needed to maintain this trend?

To maintain the trend of reducing country risk, Argentina will need to prioritize institutional stability and transparency in economic management. The implementation of structural reforms must be carried out gradually and carefully, considering the social repercussions that may arise. It is crucial that the government not only focus on short-term measures that may be popular but also look to the future, establishing a framework for sustainable growth.

It is also essential to promote an open and constructive dialogue between the government, productive sectors, and citizens. Trust is built over time and requires a genuine commitment to fiscal responsibility and social inclusion.

The economic history of Argentina is marked by cycles of optimism and pessimism, where each change of government brings new hopes and fears. In this sense, fiscal balance is not a whim; it is a prerequisite for growth. The country does not need more patches; it needs direction.

In conclusion, the recent drop in country risk is a positive indication, but it should not be considered a definitive solution. Argentina is at a crossroads where the decisions made in the short term will significantly influence its economic and social future. Effective policy implementation, combined with a solid institutional framework, will be key to transforming momentary confidence into sustainable and lasting growth.

Comments