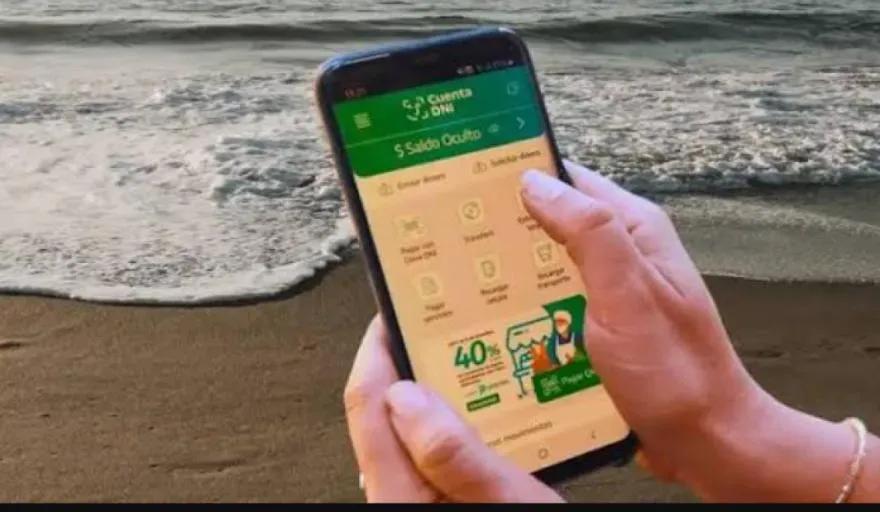

The use of digital platforms for financial management has gained relevance in recent years, especially in challenging economic contexts. The DNI Account, a tool promoted by the Banco Provincia de Buenos Aires, stands out in this regard. In February 2026, this platform continues to offer significant benefits aimed at alleviating the economic burden on Argentine consumers. How does this initiative impact the current context? This analysis focuses on the economic and social implications of the DNI Account, evaluating its effectiveness and comparing it with international experiences.

📊 Current situation and context

According to data from Banco Provincia, at the end of January 2026, the use of the DNI Account had grown by 30% compared to the same month of the previous year, reaching over 3 million active users. Inflation in Argentina remains high, exceeding 50% annually, leading to a growing search for alternatives to optimize expenses. In this scenario, the DNI Account offers discounts in various categories like food and basic services, helping to mitigate the inflationary impact on households. This context highlights the importance of digital tools that facilitate access to economic benefits in difficult times.

🔍 Analysis of causes and factors

The growth in the use of the DNI Account can be attributed to several fundamental causes. Firstly, the economic crisis has led citizens to seek more accessible alternatives for managing their daily finances. The lack of trust in the traditional banking system has driven greater adoption of digital solutions. Additionally, the provincial government has implemented informational campaigns that highlight the benefits of this tool, encouraging its use among the most vulnerable sectors.

Historically, expansive monetary policies have generated persistent inflation that erodes purchasing power. This phenomenon is reflected in a significant increase in the cost of living; for example, food prices have increased by 60% year-over-year, forcing families to find effective ways to save. The DNI Account not only addresses these immediate needs but also aligns with global trends toward financial digitalization.

🌍 International comparison and global impact

On an international level, countries like Brazil and Chile have implemented similar policies to promote the use of digital financial platforms. In Brazil, for example, the Pix system has revolutionized instant payments and transfers since its launch in 2020; more than 70% of financial transactions are now conducted through this system. This approach has reduced transactional costs and facilitated financial inclusion.

In Chile, the "Direct Transfers" program has been effective in helping vulnerable families during recent economic crises. According to data from the Chilean Ministry of Social Development, more than 80% of beneficiary households reported significant improvements in their ability to meet basic needs after the program's implementation. These international experiences demonstrate that digital initiatives can have a significantly positive impact when well-designed and implemented.

⚖️ Implications and consequences

The implications of the widespread use of the DNI Account are multiple, affecting both economic and social spheres. From an economic perspective, this tool can contribute to an increase in consumption by facilitating access to significant discounts. This is crucial in a country where household spending accounts for approximately 70% of GDP, according to INDEC data.

Socially, the DNI Account can serve as a bridge to greater financial inclusion by allowing traditionally excluded sectors to access basic banking services without having to resort to traditional financial entities. However, there is also the potential risk of technological dependency among those users who are less digitally literate or lack adequate internet access.

🔮 Strategic perspective and future outlook

Looking ahead, it is essential for authorities to continue improving the digital infrastructure necessary to support such initiatives. Expanding access to the internet and mobile devices will be fundamental to ensuring that all citizens can fully benefit from the system. Additionally, it is crucial to establish clear mechanisms to monitor the real economic impact of these measures.

Potential risks include possible market saturation or negative reactions to abrupt changes in economic policies related to these digital platforms. Therefore, it is advisable to implement flexible strategies that allow for rapid adjustments as needed.

In conclusion, while the DNI Account offers immediate solutions to pressing economic challenges, its success will depend not only on its effective implementation but also on the overall economic context and the government's ability to quickly adapt to new economic realities.

Comments