It is estimated that 4,800 cyber frauds were registered monthly in the country

Currently, it is not strange, for example, that a very small business that is having at least one Instagram account or company profile on WhatsApp. On many occasions, these sites do not have a physical location, which makes everything done online, which on some occasions may end badly. However, crimes have no limits and whether digital or in person, there is always possibility of falling into traps.Only in 2022, according to the Observatory of Cybercrime and Digital Evidence in Criminal Research at the Southern University (OCEDIC), Complaints for virtual fraud have increased by 200% compared to 2021. In addition, it is estimated that 4,800 average monthly frauds were registered.

Most common virtual crimes in Argentina

Among the most recurring crimes, highlights the technique of identity usurpation called "Phishing", that aims to deceive a user to obtain confidential information fraudulently and thus appropriate the identity of these people. According to the report Specialized Cyberdelinquency Unit (UFECI), This strategy is implemented in 25% in the "Vishing" mode, i.e. fraud through phone calls.In that same line, the organism warns about Account of personal data for bank fraud through emails. Although they claim that this type of maneuvers are not new, they usually change the facade used to present themselves before different groups of victims.

At the end of last year, in the Province Bank, according to research carried out by the Fiscal Ministry of the Nation, there were a number of complaints made by people who received in their emails a message with the logo and colors of the bank, in which they asked them to enter a link provided in the same email.

However, this address for a page very similar to that used by the entity's clients, where the user and password must be entered. In spite of the fact that the information is inserted, the deletion of personal data is realized, since Criminals receive a message with that data and can access bank accounts. In view of this, we recommend:

- always check the email address of the sender,

- contact the bank and

- Entering homebanking of official page without following the link sent

20% of users of virtual bank accounts suffered at least one scam

As we see, as virtual fraud grows, these are also more imperceptible and difficult to report. In this sense, the international computer security company Kaspersky recorded nearly 400 thousand new camouflaged malware in 2022 in different applications or programs, in total detected 122 million per day.The report demonstrates that the more frequent and alarming mobile threats are banking Trojans, that search for data related to both online banking and electronic payment systems.

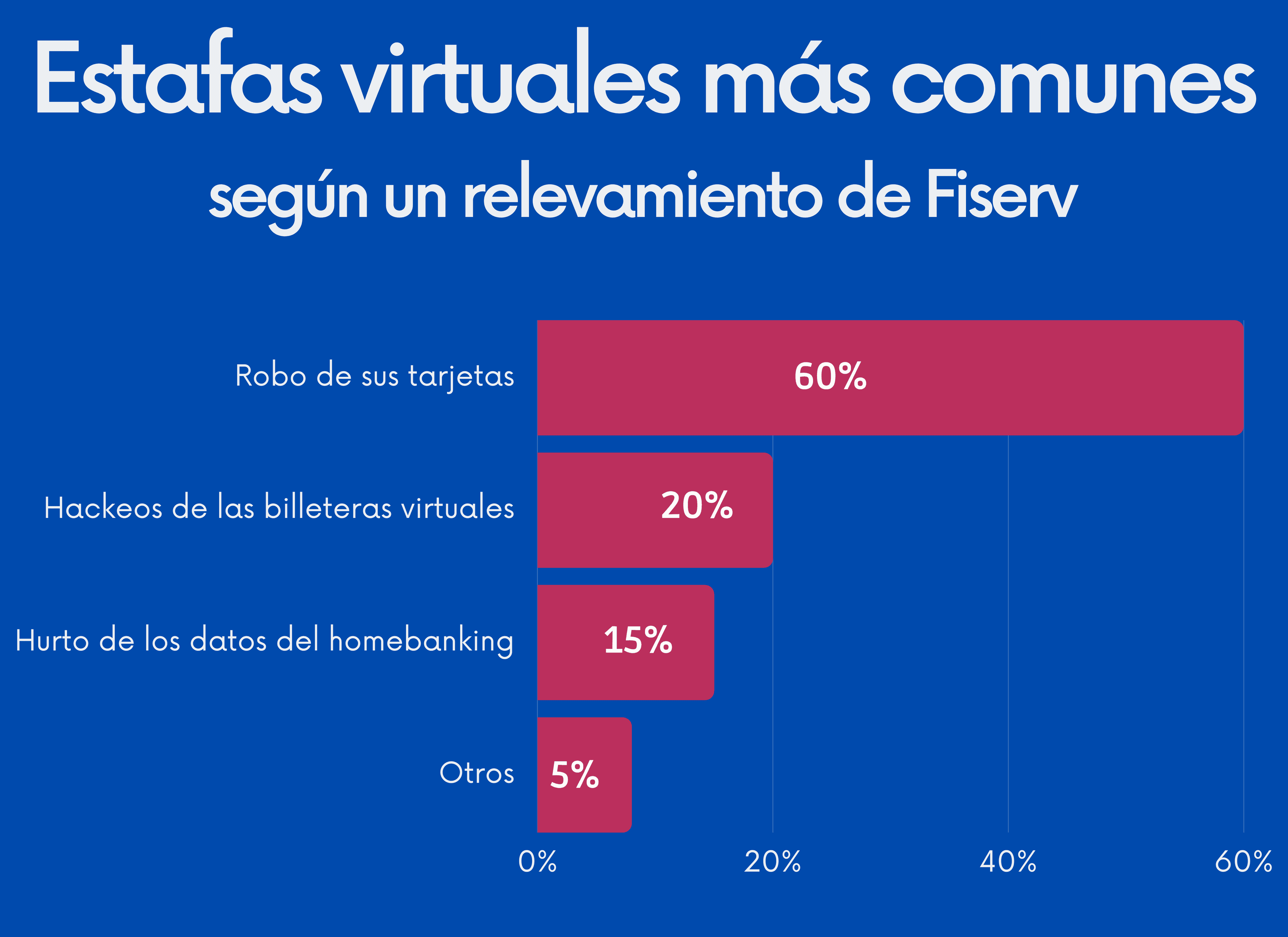

In turn, a survey carried out by Fiserv analyzed the operation of payment methods and shopping habits in Argentina, such as those carried out through bank accounts and virtual portfolios of several fintech. This study determined that 20% of end users suffered at least one fraud and 18% of traders passed through it.In detail, the report revealed that 60% of people stole their cards or their data, while 20% was the victim of hacks of virtual wallets, 15% faced the theft of homebanking data and 5% was deceived in other ways.

Stables by more common virtual wallets and bank accounts

With regard to the answers they obtained after the event, 43% managed to return the money they lost, 35% were able to solve the problem but lost silver and 22% failed to find a resolution and lost money.It is important to note that people who watch in physical trades such as bars, restaurants, service stations, among others, must be attentive and avoid delivering the plastic, as in addition, is very common theft of data when taking a picture of the front and back of the card debit or credit.

Forms of Staphas through Bank Transfers

As far as bank transfers are concerned, it is relevant to be pending on who takes place, due to some tricks ranging from making you pass through a known in trouble, to fake online novels.According to Penal Code, in its Article 172, “will be repressed with prison a month to six years, what disillusioned another with clear name, simulated quality, false titles, lying influence, trust abuse or appearing goods, credits, commission, company or denial or relying on any other ardid or deception. ”

Actions by the Central Bank

Since February last year, the Central Bank of the Republic Argentina (BCRA) reinforced the Measures to improve the safety of digital walletsand thus “receive the strategic planning of cybersecurity, the prevention of fraud and cyberresilience”.Inside Technical requirements for Payment Services Providers and financial institutions that offer the registered portfolio servicel are: double-factor authentication for digital wallets, arbitrate mechanisms to detect suspicious or unusual activities of users to mitigate the risk of fraud, manage customer consent to link your account to the portfolio where you want to operate, among others.

"The BCRA will continue to work in regulations on the management of technology risks and information security applicable to digital services offered and provided by all participants in the financial system, such as payment service providers and financial market infrastructure," the monetary authority notes.

Recommendations to prevent cyber fraud

On the other hand, the institution warned about the different procedures for fraud, such as fake social media profiles that send direct messages, phone calls, text messages or WhatsApp and other messaging applications, as well as misleading emails to obtain personal and banking data.Thus, the Central Bank makes a number of recommendations such as:

- activate the authenticity of two factors in social network accounts and WhatsApp,

- do not provide personal data by phone, email, social network, WhatsApp or text message,

- use strong passwords mixing uppercases, lowercases and numbers,

- Read each received email carefully, among others.

The truth is that we are all exposed to a fraud, so it must be very careful at the time of a transaction, ask for some loan, answer doubtful emails or transfer people to strangers and, In the event of a victim, do not hesitate to report to the competent authorities.

Comments