Judgment for the expropriation of YPF: Final Impressions

- Judge Loretta Preska must decide two core themes: the date when the Argentine State took control of the actions Repsol had in YPF, and the applicable interest rate to compensate for the damage generated by expropriation. • The failure should not take more than 45 days.

- There is the risk that YPF will once again be incorporated in the case if Argentina calls for a failure of the neoyorquina magistrate. I. Introduction

Date of Control of Actions of Repsol

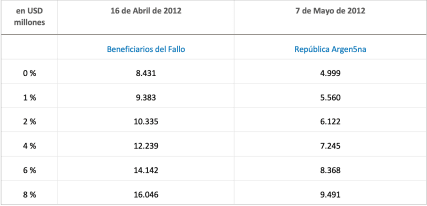

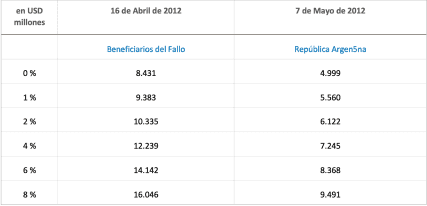

Argentina, as the new majority owner of YPF, was obliged to launch a Public Procurement Offering (OPA) for 49% of unexpropriated actions. At that time, 25% of these actions were owned by two Spanish companies, Petersen Energy and Petersen Inversive Energy, 3.8% of the fund Eton Park Capital, and the rest listed on the market.In a traditional OPA, the market, through a contracted financial entity, establishes the purchase price of the shares. However, the YPF statute provides that, if the Argentine State renationalizes the company, this price will establish a formula included in the statute and not in the market. This formula is highly dependent on the price of YPF shares at the time when it occurs “directly or indirectly and in any way or half” the event expropriation. According to the established, this expropriation event is the day in which the Argentine State “acquired control of Repsol’s actions”.The complainants argue that this date was on April 16, 2012, when Julio De Vido and Axel Kicillof (company interveners), entered the YPF tower in Porto Madero and expelled the dome Directive of Repsol. At that time, lawyers argued, executives of the Spanish oil company ceased to exercise control over YPF.Argentina, on the other hand, thinks that this date is May 7, 2012, day in which the former president of the nation signed the Expropriation Act. Argentine lawyers argue that during the three weeks prior to the Expropriation Act, the State only exercised one “temporary occupation of control of actions in possession of Repsol”, not a complete control of the company.Why is this date so important? Because the YPF actions on the day after the intervention of the Argentine State in the oil tank, they closed with a 40% drop and their quotation was suspended for 48 hours on the New York Stock Exchange (NYSE). The actions of YPF on the day after the signing of the Expropriation Act, closed without further changes. The difference between using the value of YPF shares for the closure of 16 April and the amount for the closure of 7 May 2012, is approximately an average of 3 500 million additional dollars in the global compensation that Argentina should pay to the beneficiaries of the decision of 30 March (see Chart 1).Chart 1. Calculation of Indemnization

Source: PACER, Presentation of lawyers in court of Judge Loretta Preska

It is important to reiterate that, according to the status of YPF, the expropriation occurred on the day in which the Argentine State “directly or indirectly and in any way or medium acquired control of actions [of Repsol]” and that Judge Loretta Preska already established, in his decision of March 30, that this date is not May 2014, when Argentina finally compensated Repsol for expropriating 51% of YPF's actions.Here is the first challenge of both parties: to convince the magistrate about which date it activated the obligation to launch a PA.Opinion

We consider that the legal team of the complainants adequately exposed the arguments necessary to persuade Judge Loretta Preska that the government of Cristina Fernández de Kirchner, exercised absolute control over the actions of YPF in the hands of Repsol on April 16, 2012, the day of intervention. The central axis of this presentation was the decision of the interveners to cancel the meeting of the Oil Directory scheduled for April 25, 2012, thus removing control of the company to Repsol and forbidding its directors to exercise the right to vote. In other words, we found that the complainants were able to convince the neoyorquine magistrate that the event that activated the Argentine State's obligation to launch a Public Procurement Offering for 49% of the unexpropriated actions occurred on April 16, 2012.Argentina correctly focused its efforts on the literary interpretation of the YPF statute, the Intervention Decree and the Expropriation Law. We consider that this legal strategy was appropriate, because these texts play in favor of the arguments of establishing as a date of acquisition of control of the actions on May 7. However, as the complainants’ lawyers emphasized, there is no need to look at what the texts say, but what made the Argentine government who, on April 16, 2012, completely stripped of the control of the actions by not being able to make decisions as majority shareholder.For this reason, we consider that Judge Loretta Preska will establish on April 16 as the date of expropriation "indirect" The YPF and, in this way, will establish that the PA should have occurred 40 working days before its decision of 31 March last.Interest Rate Aplicable

The second and last debate generated during the three days of the trial was the interest rate that the court should establish as compensation to the complainants. Since the beginning, it was established that this interest rate would not be 9%, as established by the Law in the State of New York. When it comes to a case that used Argentine laws, Judge Preska ordered in his decision of March 31 that the interest rate would be to be “the rate used by the commercial cuts of the Republic of Argentina”. In this way, both parties set a range between 0% and 8% annually.The discussion focuses on two fundamental aspects: the first is the rate itself and the second is since when this rate should be applied.Argentina tried to convince the magistrate that the rate should not exceed 3% a year, considering similar cases in recent failures dictated by commercial courts of the City of Buenos Aires where the central seat of YPF is located. In addition, the government argued in favour of establishing as date from which the interest rate should be applied, as April 2015, when the applicants began the trial against the State and against YPF. To defend their position, the lawyers representing the Argentine Republic used testimonies of Argentine constitutionalists who said they said that " Argentine commercial law establishes that the interest rate must be applied since the day the crime was committed” and that, as the YPF statute does not establish a specific period in which the State should have launched the Public Procurement Offer, this crime may only have occurred when the complainants officially filed a formal complaint in the form of judicial demand.The complainants ask that the interest rate be not less than 8% annually, calculated since April 16, 2012, when Argentina intervened YPF and generated economic damage to shareholders. Their arguments are simpler and did not present specialists to test in favor. They were only limited to persuading Judge Preska that Argentina delayed compensation to the damnedified for a decade without paying interest. They also added that the beneficiaries of the failure, when they do not charge for 10 years, are creditors of a nation whose cost of financing abroad does not fall from 15% and now seeks to pay a interest rate below 3%.Opinion

We consider that Argentina has made a very solid presentation to reduce the interest rate below 6%, as we also understand that reaching a 0% interest rate is unattainable and the government knows that. The Argentine witness managed to explain in detail that no local commercial court would apply a rate exceeding 6%, in addition to some specific examples presented by the complainants who did not offer a witness to explain the context of these examples. In this sense, we think that they generated doubts while Argentina, with its witness, offered solid arguments.We also consider that the interest rate should be applicable since April 5, 2015, when the first case was presented and November 3, 2016, when the second case was presented. Although both cases were consolidated five years ago, we think Judge Preska will differentiate the applicable date for calculating the interest rate. However, the economic impact on this differentiation will be minimal, as the second case, presented by Eton Park Capital, does not represent more than 10% of global indemnity.Next Steps

The Fallo

In a few days, both parties must present writings that resuminate those points they wish to clarify and that they could not be presented during the trial last week. Since then, Judge Preska will begin writing the decision and the date of its publication is uncertain.Over the eight years of the case, The neoyorquine magistrate has shown to take the time necessary to publish those errors that required time to deliberate. This is one of them. Since the beginning of the case by the expropriation of YPF, Judge Preska faced three critical instances: In 2016, it took 51 days to publish a transcendental error in 2020, it took 119 days and, more recently, the judge took 279 days to publish the decision that found Argentina responsible for the damage caused by expropriation. This will be the fourth crucial failure that the judge will face since April 2012.We think this is Opinion and Order (as known in the legal context) is not of extreme complexity and that Your publication should not take more than 45 days from next August 4when the parties present their final writings. For now, we believe that Judge Preska does not speculate with a change of Argentine legal strategy with the arrival of the new government (if any) and that it will not take its publication until after the October elections. However, our opinion may change over the weeks.Appeal

Argentine lawyers have already advanced that the government will appeal to the decision of March 31, as we know the overall amount of indemnity. Let us remember that Argentina cannot appeal until Judge Preska publishes the decision.When Argentina appeals, we think that Burford Capital will also appeal to the March 31 failure that exonerated YPF, and will seek to include it again in the case. The reason is simple: Burford considers he can use oil assets to force the government to negotiate a payment and avoid the multiple embargoes the country faces in the future. Therefore, we reiterate our caution (in legal terms) for the future of YPF that this year has already celebrated the favorable closure of two billionaire cases in its against: Maxus Energy and the case for expropriation. Burford is a phenomenal rival that Argentina and YPF do not want to face in a supposed embargo process. At first, the execution of assets would be exclusively against the State, since YPF would not be included in the case until the Court of Appeals was expired, probably in nine months.In order to avoid a probable process of executing sovereign assets, the neo-yorquine law stipulates that Argentina must deposit assets equivalent to the amount of the failure. Something impossible for our country. For this reason, the Government has three possible alternatives: (1) not to offer guarantees and risk embargoes as it calls, (2) to ask Judge Preska to admit a guarantee whose value represents a fraction of the total value of the decision and (3) not to appeal and to allow the next Government to take the You have the case. This last alternative is the most appropriate always and when the magistrate takes the fault until December 10.Finally, assuming that the appeal remains and the judges issue a failure, the losing party will safely seek the opinion of the U.S. Supreme Court.Payment

Sooner or later, Argentina must pay compensation for expropriating YPF without respecting its statutes. This is a reality and the possibilities that our country leaves unharmed of this cause are almost null.Since the beginning of the current year, We have made numerous consultations on the structure of payment that Argentina will negotiate with Burford Capital. As the months pass, we will further develop the following points as a result of these conversations we have had. All the following alternatives assume that the Republic will not pay the total amount of the failure, but will negotiate a discount.- BonosBurford can accept that country the emit directly New York Law sovereign obligations. One or more investment banks must be part of the process, but the investor community will not be invited. As the Argentine sovereign debt quotation continues to grow, fewer obligations will be needed to close an agreement with Burford.

- Union loan: A number of major international investment banks may offer the government a partially secured loan for sovereign obligations and guarantees from a bilateral or multilateral entity.

- Deadline Payment: With this alternative, Argentina and Burford can negotiate an agreement at 7 or 10 years, with semi-annual disbursements in cash at an interest rate reflecting the country's liquidity risk.

- Arab sovereign funds: In the absence of international capital markets willing to offer “traditional” financing, Argentina may require financial assistance from the sovereign investment funds of the UAE, Saudi Arabia, Kuwait or Qatar, either by offering it obligations or by requesting a loan guaranteed by sovereign obligations.

- Debt emission: With the optimism that perhaps managed the results of the presidential elections, Argentina would have a minimum possibility to issue debt to pay the judgment of Judge Preska, similar to the debt issue that held former President Mauricio Macri to pay the sentence for the trials initiated by the holdouts.

- Securitisation of the Agreement: We consider that Burford has the possibility of issuing a financial instrument guaranteed by the payments that Argentina will carry out (see alternative #3) and thus receive the entire early failure. The structure of the instrument, coupon and maturity will depend on the agreement that the company closes with the Argentine State, and it will be considered the interest of the investors to acquire Argentine risk.

Comments