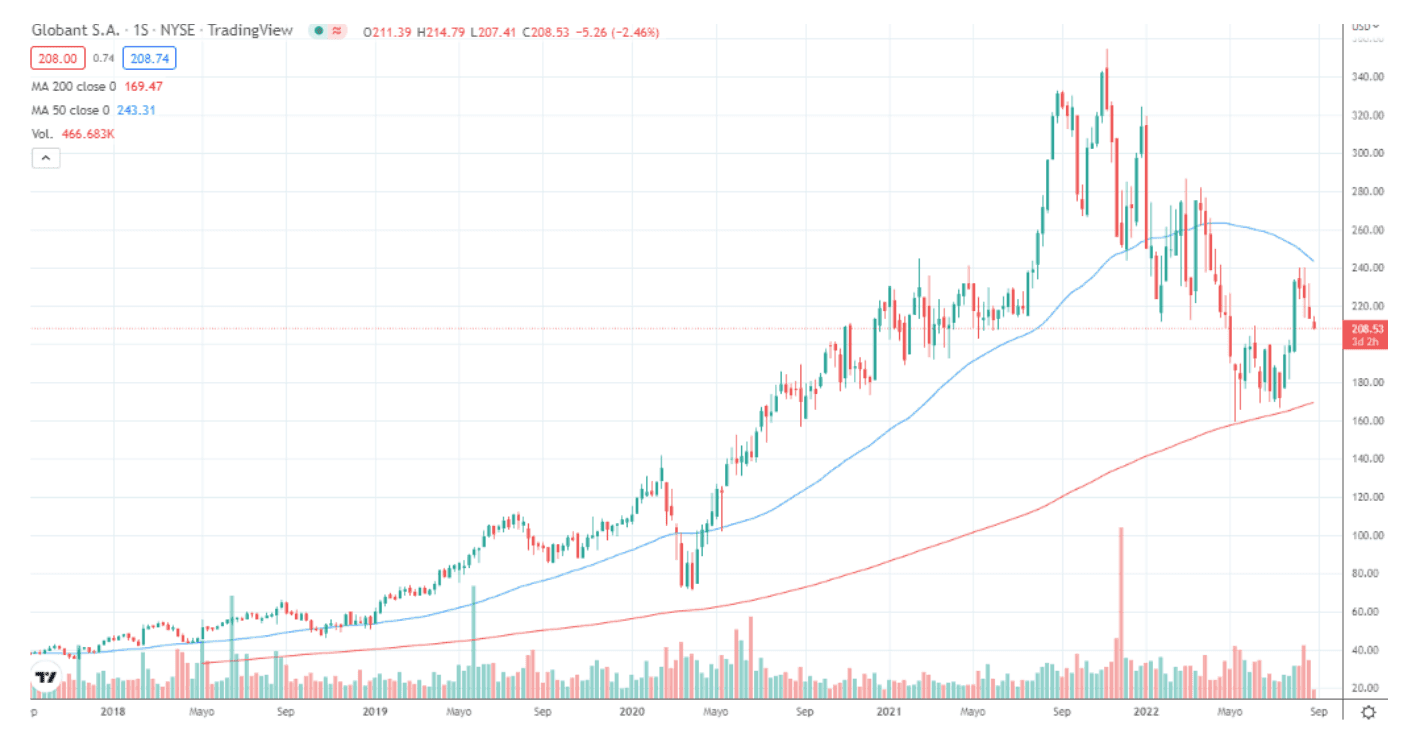

Globant (GLOB) is one of the most successful local computer technology companies, as well as being one of the largest unicorns in Latin America (businesses with more than billion dollars of stock capitalization).The company today provides software solutions: engineering services, design and innovation services for its customers, whose focus is on America and Europe. North America provided most revenues with 63% of sales, highlighting the US as the main destination. Latin America and others represented 24% Europe 11% and Asia 2%.This year it plans to invoice nothing less than $1,700 million, and one of the great comparative advantages it has is that 81% of this billing is denominated in US dollars, which provides you with hard currency income with an important proportion of Argentine peso costs.The company is registered in Luxembourg, but its main operational subsidiary, from where it was born, has its headquarters in Buenos Aires, Argentina. Globant has a presence in 20 countries and more than 24,500 employees in the world: it operates 25 delivery centers through 16 cities in Argentina (allied with offices in 6 cities), Brazil, Colombia, Mexico, Uruguay and USA. In August he opened offices in Warsaw (Poland) as a new step in the expansion plan for Europe.It provides in-house engineering assistance (internal), IT and services that evaluate customer experience, games, Big Data, UX, mobile, cloud (cloud services), product innovation and personal accessories.It is one of the nine Argentine unicorns (emerging technology companies) with a value greater than USD 1 Bn. Everything was born as a dream of four friends in La Plata, Argentina. He was a group of dreaming engineers: Néstor Nocetti, Martín Migoya, Guibert Englebienne and Martín Umarán created Globant. His first major business was the administration of the website www.lastminute. with, with which they went from billing $200 thousand in their first year to $3 million in the second. In 2006 he began working for Google as an external software developer. It did not miss much for FS Partners la fondeara worth $2 million, Riverwood Capital a few years later with $7,8 million and FTV Capital for $20 million.Among its top Globant customers today stand out Google, Electronic Arts, JWT, Sabre, LinkedIn, Hotwire and Walt Disney. The top five customers and the top ten Globant customers account for 11%, 27% and 39% of revenue. In total, 1,195 customers are divided into 8 main sectors that are assisted operationally representing the following proportion of the total turnover of the company in 2022: Banks, financial and insurance services with 22%, Means and entertainment 21%, Mass consumption, retail and manufacturing 14%, Professional services 13%, Technology and telecommunications 14%, Tourism 8% and Health 8%.As in almost all the companies in the sector, the evolution of its action followed the steps of Nasdaq, in a year when the Fed rate policy and the rest of the central banks undertook its impact on markets, and especially in the technological sector and in growth firms:

GLOBANT (GLOB): Quotation evolution 2017-2022

Source: TradingView

The numbers smile

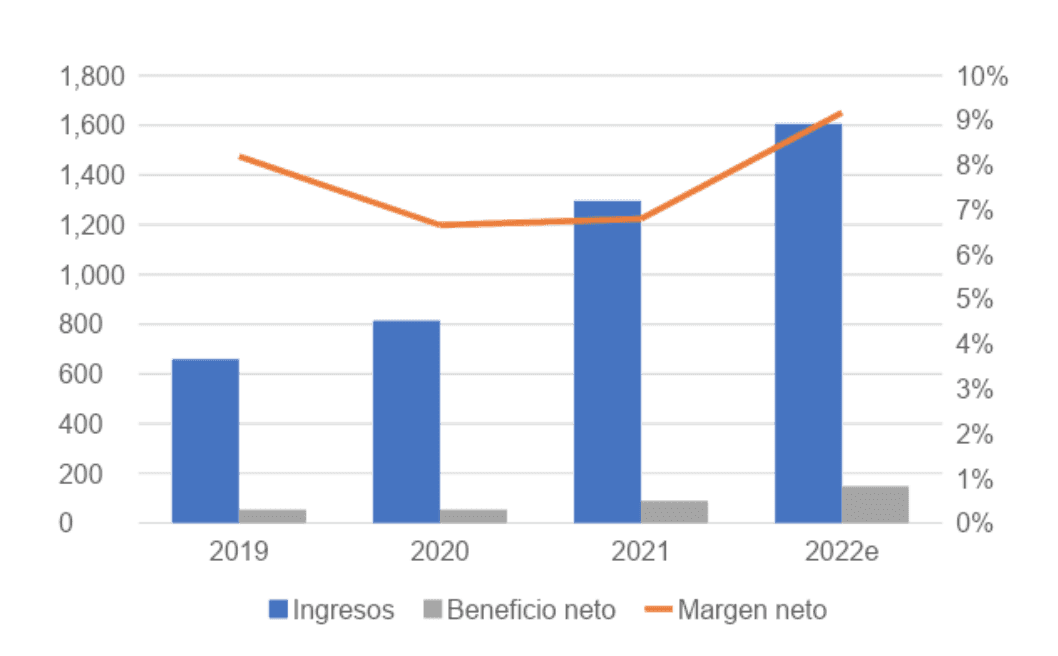

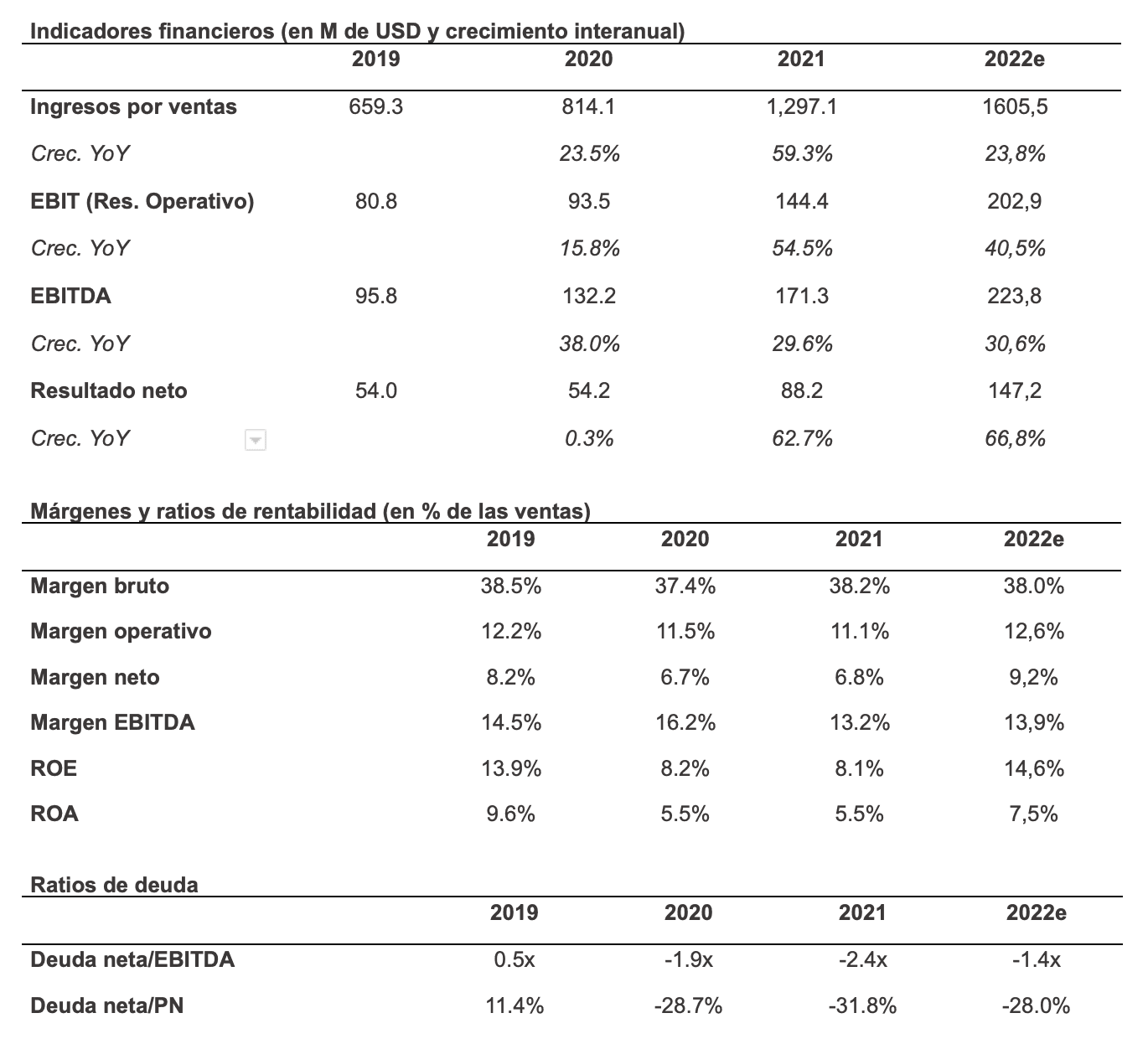

Although the last figures in its balance sheet of the second quarter of 2022 have shown a slowdown in quarter to quarter growth, it continues to maintain a high annual growth, which few companies in the sector are holding in 2022. Based on USD 429,3 M invoiced (+7% QoQ and +41% YoY), profit per share (0.87 USD) grew by 81% homologous, and this has already been depurated by the effects of pandemic.Through EBITDA we can infer if the business works: it is the operational result of box, i.e. by incorporating the amortizations (which are not an erogation of funds). In dollars, the company has been increasing 51% homologous. The recession in the US and the weakness of the rest of the central markets, for now, costs Globant.Research for Traders estimates that the gross margin will be 38.0% this year (38.2% in 2021), with its operating margin increasing up to 12.6% and a net margin of 9.2%, increasing by 6.8% of 2021.GLOBANT (GLOB): Operational projections

Source: Refinitiv and Estimates of Research for Traders

The consultant projects that EBITDA would increase by 31% compared to the previous year, with the EBITDA margin by 13.9% in 2022, and a ROE and ROA of 14.6% and 7.5% respectively.GLOBANT (GLOB): Operational projections

Source: Refinitiv and Estimates of Research for Traders

As regards devaluation, Globant is not a cheap action in relative terms, but it is precisely for its quality. It has a Price-to-earnings trailing (price to earnings) 12 months high compared to its comparable but low: The price ratio to trailing earnings of 75x with the action in values not very different at the time of writing this article, the action quoted with a relationship of 66x, that is, cheaper. And seeing market consensus, it would be reduced to only 39x at the end of the year. In addition, the ratio price-to-sales trailing 12 months is above the comparable ones if we take a sample of the sector, but in the case of the price-to-book value, the same is below most comparable ones.It's not an indebted company. In addition, the net financial debt as part of the capital would follow negative values at the end of 2022 (depending on the EBITDA would be -1,4x). Leverage is expected to remain low, as the capital would balance 53.1% of the asset in 2022, after 49.9% in 2021.We are more concerned about the general context of low-markets by increasing the risk-free rate than the company's leading, which remain very solid. But markets have their logic and this is not a time to be risky, so to choose good deals like that of Globant, but to wait for the right time to arm positions guarding the capital.

Comments