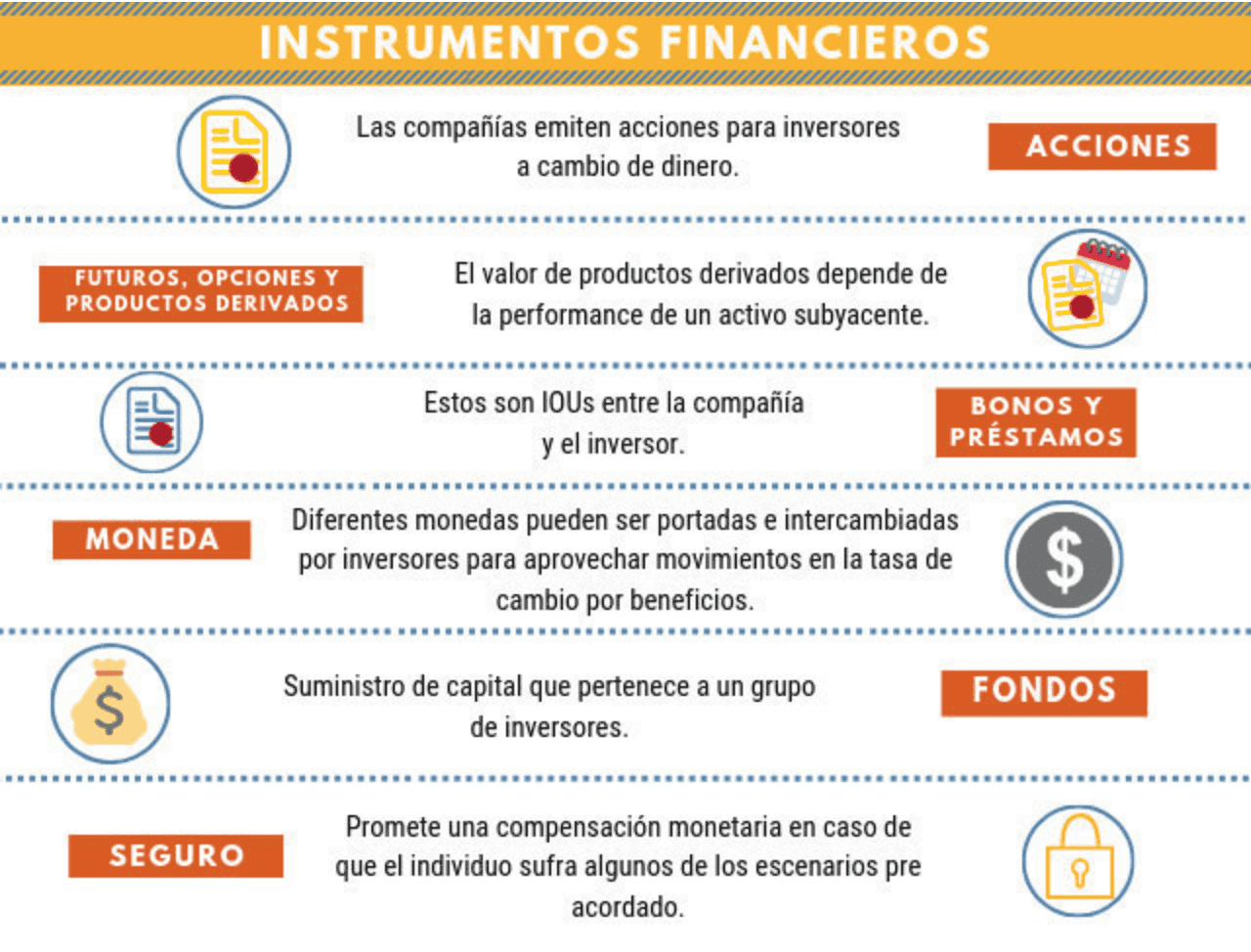

One financial instrument It is something that has value and can be exchanged. It can be money, currency, shares, debt or loan. It may include portion of interest in a company or another entity. Many financial instruments are electronic.

How do they work?

It is a legal agreement that requires a party to pay (or promise payment) money – or something else of value – to another person or organization. It usually has conditions in the agreement. These can detail the amount and interest of payments, money, etc. As proof that one owns a financial instrument there are stock certificates, a insurance policy or debt or loan contract, but they may also be in an online account.ActionsCompanies issue shares for investors in exchange for money. It is a legal agreement between the company and the carrier of the shares that may include payment of dividends (when the company can do it) or benefits for the time you carry these actions.

Futures, options and products derivedThe value of derived products depends on the performance of an underlying asset. They are exchanged to provide growth capital, or to limit risk in business or portfolio.

Bonos and loansThese are IOUs between the company and the investor. The investor gives the company or government money and, in return, the provider pays an interest to the investor over a previously established period and an established price with a specific date for the return of the capital.

Coins (Millions)Different currencies can be covers and exchanged by investors to take advantage of exchange rate movements for benefits.

InsuranceAn insurance policy involves the company and the individual paying a premium to an insurance company, thus establishing a contract that promises monetary compensation if the individual suffers some of the pre- agreed scenarios.

FundsAn investment in funds (such as an ETF fund) is a capital supply that belongs to a group of investors. This money is invested by the fund in the hope that the price of the fund's action increases, giving investors a profit. You can also pay interest.

You need to know

Capital gain: Gain from the sale of an asset, as can be actions.Risk: It is the possibility that the return of an investment is smaller or different than expected.

Wallet: Investment set that has both an individual investor or an organization.

Why have financial instruments?

Growth and dividendsInvestors buy and exchange financial instruments to receive a capital gain, or to receive interest from a bonus or share dividends.Risk controlBuying assets that perform independentmene of each (actions of a country, obligations of a government, for example) can help reduce risk in the portfolio.

Prepare for the unexpectedAn investor wishing to have greater coverage in his wallet can buy insurance for his wallet in case of falling in value. Having an insurance gives you protection against losses that are established in the policy.

Comments