Dolarization is a monetary process in which a country adopts the U.S. dollar as its legal course currency, so it is not only necessary the will of the country, but also the good visa of the Federal Reserve. IMF technical and financial support is also recommended.

The best examples of dolarization can be seen in countries such as Panama or Ecuador. In Panama, the dollar is a legal currency and lives together with the balboa, bringing years of stability, investments and growth to its economy.

In Ecuador, in 2000, there were remarkable improvements in terms of the purchasing power of the Ecuadorian citizen, recovery of real wages, and improvement of the quality of life.

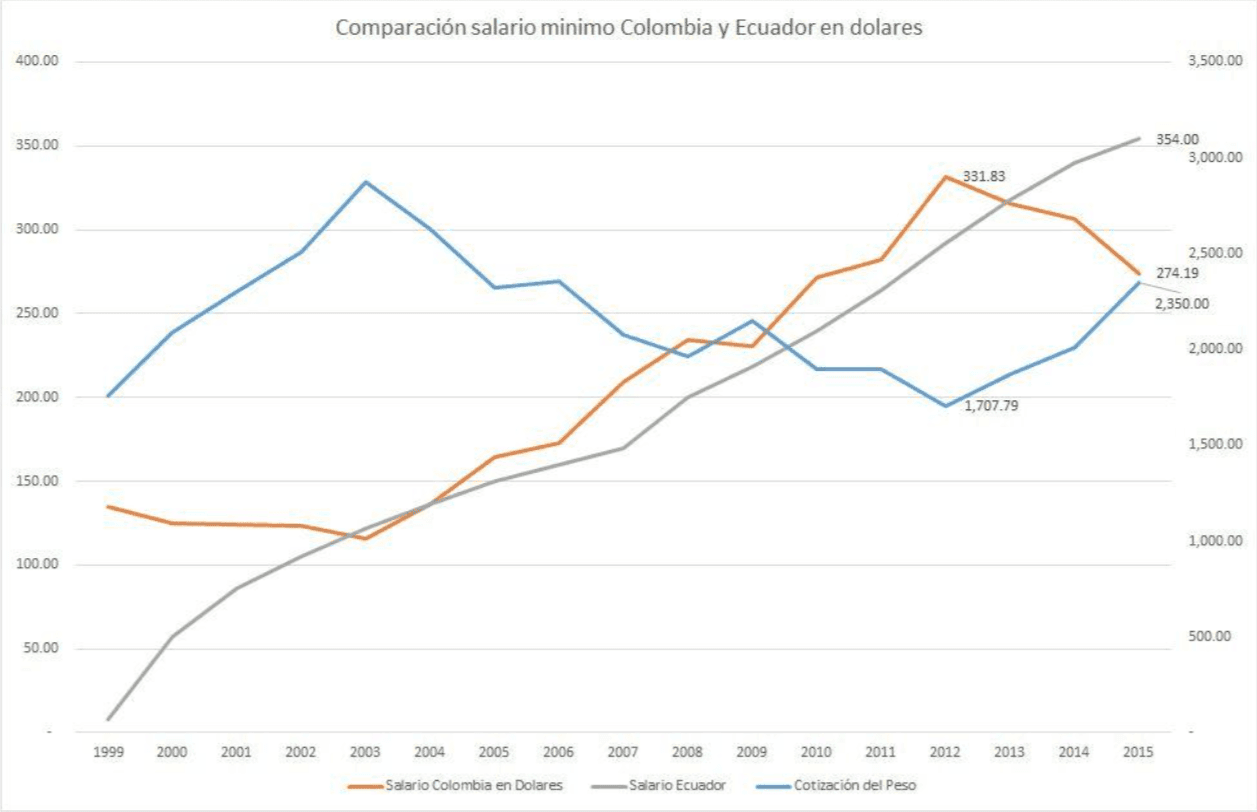

Here we can see two charts that show the benefits of dolarization:

Source: World Bank -BBC

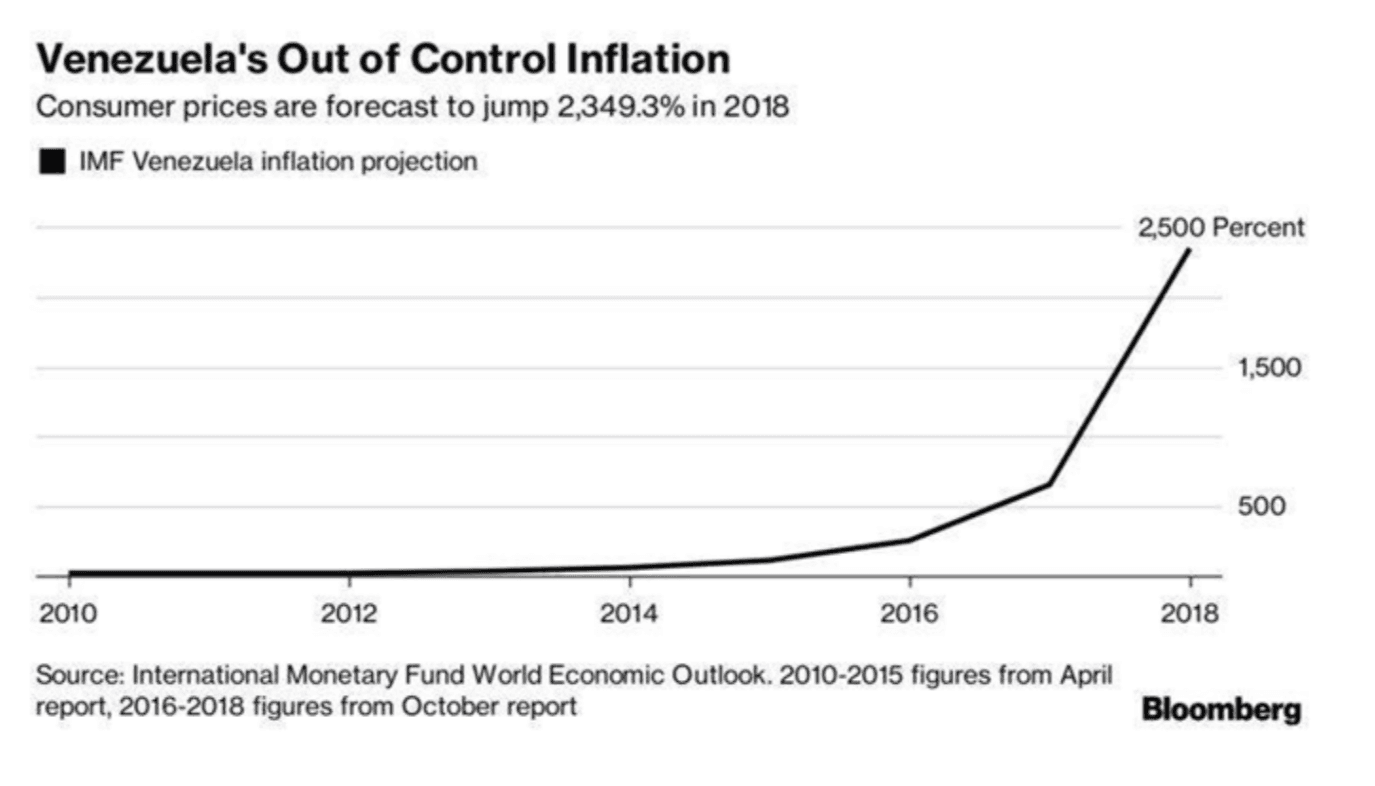

Source: World Bank -BBCAnother interesting example is the de facto dolarization and disorder (no legislation) but spontaneous, which suffered Venezuela after the spilt fall of the value of the bolivian with the socialist model, the loss of economic freedoms, grotesque fiscal and monetary disorder, expropriations and the deterioration of property rights.

Venezuela in hyperinflation since 2016, is leaving this process thanks to the informal dolarization of 70% of productive and commercial activity.

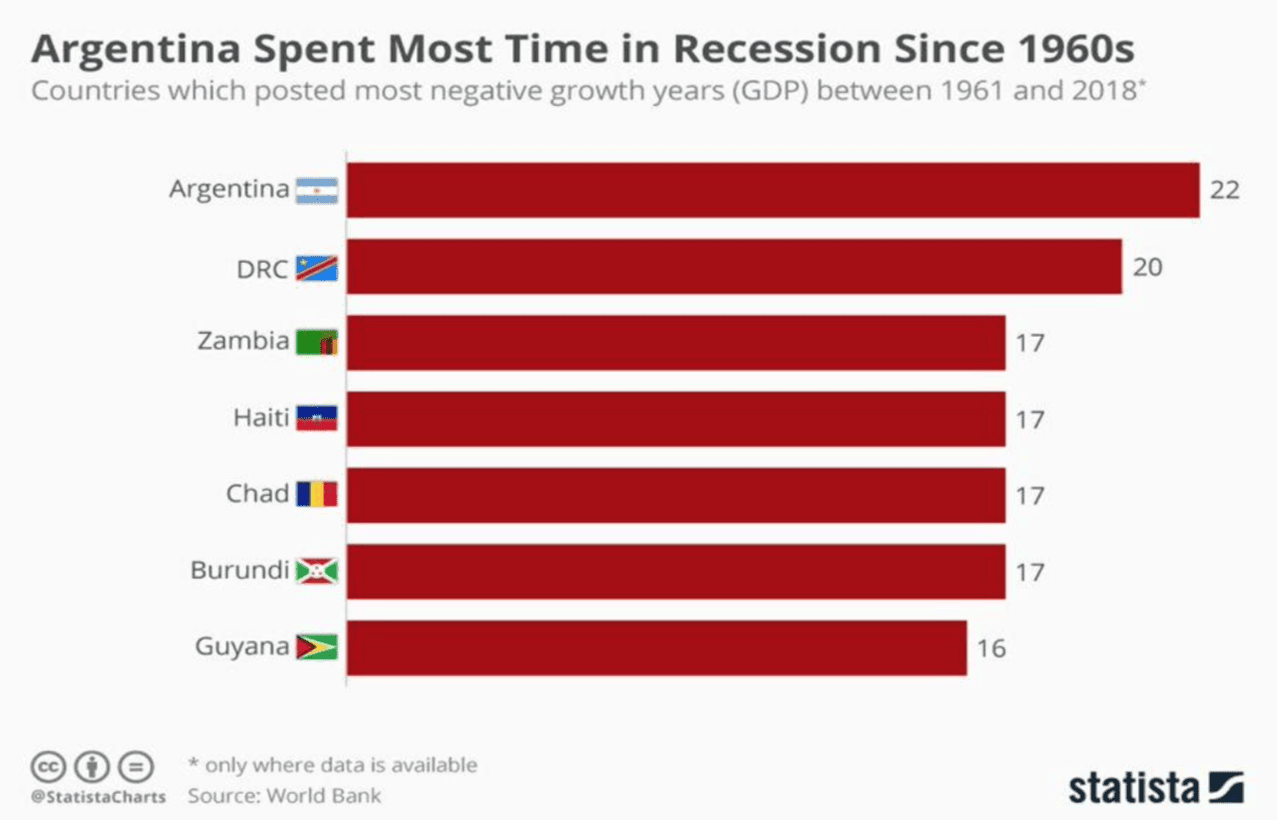

In Argentina, recently Mr Javier Milei opened the debate again on the convenience of spreading the economy. Today, Argentina began to overcome monthly inflation even to the Venezuelan economy, and presents serious risks of going to a hyperinflationary process.

In my opinion, these would be some advantages and benefits of donating the Argentine economy:

- With formal and integral dolarization it would be final to the historical loss of the value of the Argentine peso present in the economy since 2002.

- A progressive recovery of the real wages of the workers and pensioners, as occurred in Ecuador, where after donate in about 15 years, the real minimum wage of $40 in 1999 to $354 in 2015.

- Dolarization as the center of a stabilization program would enable effective and rapid exit of the pre-hyperinflationary framework and sincerity of the economy, limiting the future size of the state, public expenditure and debt.

- It would be a new virtuous cycle of sustained growth without inflation, which would translate into an improvement of GDP and per capita income. Argentina since 1960 is the country that had more years in recession:

Source: Statist

Source: Statist- Dolarization eliminates exchange risk, and introduces stability to attract important national and foreign private investment flows (IED), necessary to finance large investments in the oil, gas, agriculture and electricity sector, for example.

- Dolarizar reduces the country risk, the cost of business capital, by ende, would increase the value of Argentine business and companies, generating wealth and greater exporting potential for the country.

- It would increase the development of financial and capital markets as sources of business and business financing.

- By improving economic conditions, it would reduce the escape of human and professional talent, which is generated in Argentina in recent years, an important intellectual decapitalization of the country (most important qualitative reason).

Comments