With the sorpressive victory of Javier Milei and his unorthodox proposals in the PASO; since last Monday to the first hour, dolarization is the head of all and is undoubtedly the greatest source of uncertainty with which we deal both the citizens and the local and global investors at the time of imagining Argentina in the medium and long term." For each complex problem there is an answer that is clear, simple and wrong".

It is good the speech and the narrative square very well in the current context. But is it really the only way out? It is indisputable since Argentina must go towards fiscal contraction to prevent excessive debt, and free the economy to drive productivity. However, dolarization is an extreme measure and it is not clear that the people are so much of what this would entail, nor the risks linked to such a bet. At this point, we must also know that magic solutions do not exist... that the path is long, and there are no shortcuts.

As well as Milei candidate in his post-PASO speech, Argentina had fiscal surplus in just 10 of the last 122 years. That is, Argentina has been for over a century a terrible victim of dependence on excessive expenditure. And our excess cycles have always been the same: we spend more than we generate, indebted in local currency, excessive domestic indebtedness is funded by the central bank and the inflation licuates everything. But we are becoming stagnant and large-scale external debt becomes untenable, we have talked, restructured, plucked capital controls, disaligned incentives, we have returned.

Dolarize looks attractive

People are trying to save in dollars and a lot of daily transactions - but they end up being settled in weights - they are taxed in dollars, so our economy is already a certain form informally dolled due to lack of confidence in weight. This is how total dolarization does not seem too distant, and much less disruptive.I'd be a thug! People are spared the friction of having to quote in a currency and settle in another currency, they could save directly in the currency with which it transactions without having to access any exchange rate market and, above all, remove politicians the ability to indebted and waste their excessive emission expenditure. The government would assume the fiscal commitment, ensure that monetary funding was no longer granted, and inflation should decrease sharply and sustainably, since the credibility of the country would be linked to US monetary policy.

Not so fast

However, doarizing is a high-risk strategy and potentially an outbound street more than a major contraction and collapse of our economy. Under dolarization, the growth of the country depends purely and exclusively on maintaining a surplus in the current account and generating revenues from external capital. What is not something we can expect since we go and every year, but also does not sound unheaded... provided that the global macro context is good, the prices of raw materials accompany, have a state of solid law and the currency is competitive.However, our experience in the 1990s and the 2000 principles brings us a reminder that it should make us sound more than an alarm before considering dolarization.

Who deposits dolares, will receive dolares

Although in the early 1990s there have been impressive progress towards stopping hyper and restoring growth through the convertibility plan, the budget deficit and the debt have not been controlled. And at the end of the decade – after the crises of Mexico, Asia and Brazil, in addition to a strong dollar and the fall in prices of base products – Argentina - with the currency tied to a dollar, lost external competitiveness, and growth declined as unemployment and the current account deficits fired. It was not possible to solve the external deficit and we lost access to the market. Thus, given the large sum of external bonds denominated in dollars; the investors resale all the Argentine obligations, the interest rates flew unsustainablely, ripped the capital controls and the convertibility plan collaborated culminating in political, economic and social chaos.Although the convertibility plan was a convertibility box - in which local currency and USD coexisted at a fixed exchange rate, a dolarization would have similar benefits and would face the same challenge. These measures can help stabilize the inflationary situation at a start, but they can hardly have sufficient resilience to navigate external shocks and be sustainable in the long run when the wind blows against.

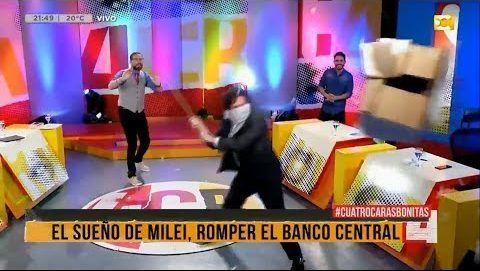

The problem is expenditure, not the currency. What we need is not to donate, but just to stop spending more than we can.

If you want to stop smoking, what do you do? Do you focus on learning to live without buying cigalos?

Comments