The first quarter of the year brought a great change of trend and a level of volatility that took many by surprise. Funds of technology companies that have had great performance since 2020 recovery accumulate significant losses during the current year (YTD). The star background of manager Cathie Woods (ARKK); Vanguard's technological background (VGT); and Global's Fintech fund (FINX) accumulate lows of 32%, 12% and 20%, respectively. Our analysis indicates that these casualties correspond to investments in technological companies that have had significant price increases in previous years and that now abruptly receded the new risks that come into play. Many analysts compare this situation with 2001, since in the middle there are again young companies of the technological space, which have a short history of gains and multiple devaluation much higher than the historical average.For example, Teladoc (TDOC), one of the main holdings of ARKK, quoted at $ 82 per share in early 2020 and in the second quarter of 2021 it was worth more than 300. This implied that the company that has not yet managed to generate earnings, had - at its peak - a 23 times higher price than its sales when the historical market average is 1.65 P/S (Price to Sales). When writing this article, the action is again in two digits, representing a massive loss to any investor who had entered the peak.The justification in 2021 was that, although many of these companies were not yet able to have a positive bottom line, long-term projections were very encouraging and with the rates at historical minimums, the earnings discounted at present showed high ratings. However, as it progressed 2021, we saw how inflation in the US began to boost, partly by the monetary and fiscal packages implemented in 2020 and also by the imbalance in supply caused by serious problems in the global supply chain.Thus, for the purposes of 2021, there were speculations that the American Federal Reserve could start a flooding program to reduce its balance sheet and increase short-term rates to combat inflation (February inflation was 7.9% while the long-term objective of Fed is 2%). According to analysts, this should affect the price of actions that most depend on low rates and economic stimulation. Last Wednesday, March 16, Fed President Jerome Powell announced an increase in short-term rates of 25 base points and the median of the members of the Federal Open Market Committee estimates 7 more ups for this year, to end with a rate of 1.9% in December.Although at first it seemed that small technologies would be the only ones affected, the largest and successful companies seem not to be exempted. Facebook, Paypal, Netflix and Salesforce are just a few examples of companies loved by the big funds that this year suffer astronomical falls. Facebook has launched more than $400 billion of its market capitalization in this quarter, an amount similar to Argentina's annual GDP. According to Goldman Sachs, coverage funds began the year to recover, leaving the technological sector and moving to energy and banking (value sectors), which partly explains the fall in the sector. To add to the disorder,The war in Russia caused enormous rises in oil and wheat prices, key raw materials for the American economy, because they directly affect people's pockets (if inflation was already high, what will now come?).In summary, several threats can be identified for the coming months:

- Severe increase in rates, Goldman Sachs provides 2 subas of 50 points and 4 subas of 25 points

- Extension of war, affecting supply chains. Given the inflation level of the last decade and the relative stability in the oil price, the managers of Andurand capital (Hedge fund of commodities) believe that the raw could reach the 200 dollars a barrel this year.

- Even with contractive policies, inflation could continue to grow and the economy could stop growing, generating stagnation

- The treasury bond curve gives signs that it could be invested (when this happens the odds of recession are high).

- China: After the Chinese real estate market, along with ultra-restrictive covid policies, can affect supply chains and reduce the economic level.

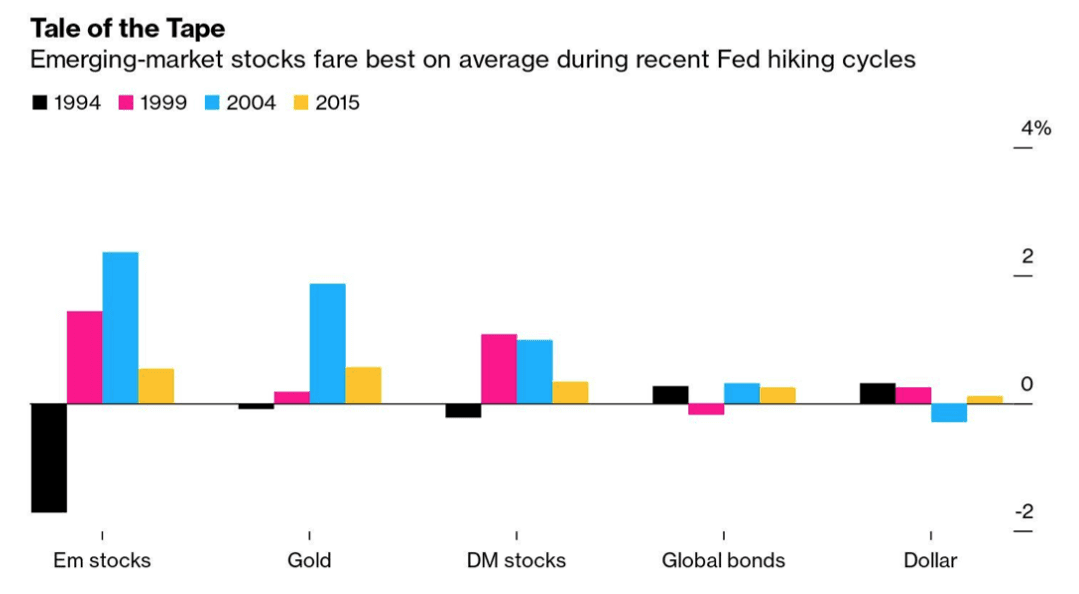

Source: Created by Nicholas Istvan Kiss, CFAFinally, emerging markets emerge as a possible diversification option. China, India and Brazil are examples of emerging people who have had a complicated 2021. Political problems, economic slowdown and high inflation have affected the prices of most industries in these markets. For example, the MSCI China ETF (MCHI) ishares fund fell from its peaks from almost 100 to 56, becoming attractive to investors. The same happens with the Indian and Brazilian indices. According to Bloomberg analysts, in recent periods where there have been subas rates, emerging markets have outperformed the incomes of the vast majority of assets.

Source: Created by Nicholas Istvan Kiss, CFAFinally, emerging markets emerge as a possible diversification option. China, India and Brazil are examples of emerging people who have had a complicated 2021. Political problems, economic slowdown and high inflation have affected the prices of most industries in these markets. For example, the MSCI China ETF (MCHI) ishares fund fell from its peaks from almost 100 to 56, becoming attractive to investors. The same happens with the Indian and Brazilian indices. According to Bloomberg analysts, in recent periods where there have been subas rates, emerging markets have outperformed the incomes of the vast majority of assets. Source: Bloomberg

Source: Bloomberg

Comments