A financial instrument that has acquired great relevance in recent years, is the famous Green Bono (Green Bond in English). It is a debt instrument that is issued for financing projects that seek to generate a positive impact on the environment, such as ecosystem restoration, renewable energy generation or pollution reduction. The financial mechanism works as a traditional bonus, a fee for the coupon (which can be paid semi-annual or annual) and the capital to amortize. They are normally linked to assets and supported by the issuer's financial balance sheet, so they usually have the same credit rating as other debt obligations of the issuer. Investments in green bonds tend to be from institutional investors, entities like mutual funds, hedge-funds and endowments of institutions that have much capital to invest in debt instruments. Either way, for investors retail that wish to add this type of investment to their portfolios, there are many mutual funds and ETFs that offer exposure to the world of green obligations.

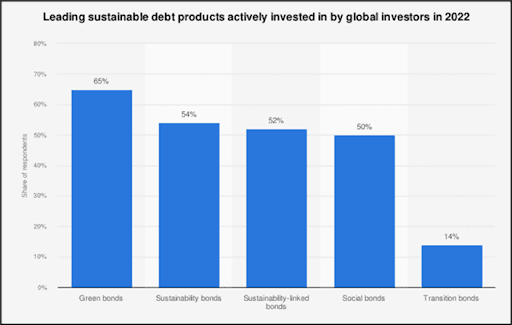

Accord the data provided by the financial data company “Statist, In 2021, about 500 billion dollars were sold in green bonds.

There are also in other varieties and colors, we can meet with different bond ratings according to the impact they seek to achieve:

- Social Bonos: Some of the areas that are usually supported by this type of bonus are:

- Work: social obligations provide funds to save or create more jobs, prevent labour risks and improve working conditions in a community.

- Health: Some aim to raise funds for the health sector, such as the purchase of beds for hospitals, the increase of vacancies and the acquisition of medical supplies.

- Housing: Social obligations can help more people find housing or provide financial assistance to tenants.

- Financial services: they seek to empower the most vulnerable or at risk of exclusion, to what is known as Financial inclusion.

- Blue Bonos: This is a debt instrument for projects related to the conservation and protection of marine ecosystems. They may be issued by companies, financial institutions or governments wishing to allocate funds to projects related to seas and oceans. Currently, China remains a leader in emissions of this kind of bonus.

- Purpura bonos: This fixed-income instrument is applied to projects aimed at boosting women to achieve equal conditions in the economic and business world.

- Bonos Naranja: the concept of the orange economy, this financial instrument seeks to allocate resources to projects and enterprises linked with the cultural sectors of this economy. According to UNESCO, it is called the orange economy to join sectors of the economy whose goal is the production or reproduction, promotion, diffusion and/or commercialization of goods, services and activities that have cultural, artistic or heritage content.

Source: Statist Tomato (2022). Recovered from: https://www. statista.com/statistics/1196890/sustainable-debt-securties-institutional-investors-esg/.

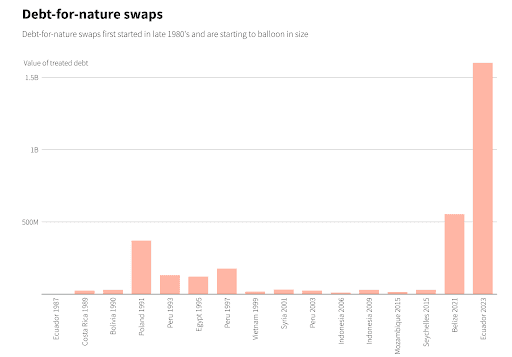

Debt to Nature Swaps: another instrument for the environment, new?

The translation into Spanish could be literally understood as "change debt by nature" It is not a concept or a new financial product. Debt exchanges by nature have existed since the 1980s but have lived a boom in 2021. The swap consists of reducing the debt of countries in exchange for investment commitments in the environment, for example, taking care of the ecosystem. The key to these instruments is that the government can reduce its debt and generate impact at the same time, with the promise to invest in the environment. In turn, international bodies function as guarantors of the issue of new debt and from this “credit improvement” governments end up indebted to the lowest rate than the previous one. Some of the most outstanding examples in Latin America were:

- Belize 2021: For example, the country managed to reduce its debt in exchange for naming 30% of its marine zones as protected areas and allocating $4 million annually over the next 2 decades to marine conservation. The old debt was replaced by a new debt issue under the term “Blue Goods”. The U.S. government development bank “Corporation of Financing for International Development” (DFC), provided an insurance that allowed the loan to have a low interest rate.

- Ecuador 2023: Credit Suisse helped the government rebuy about 1.6 billion dollars of debt for a significantly lower value (USD 644 million). In return, the government committed itself to spending $18 million a year for 20 years in the conservation of Galapagos, including the protection of a marine reserve. The former debt is replaced by a "Galapagos Boy", which will win in 2041 and is much more economic to maintain since it will be secured by the United States International Development Corporation.

Source: Reuters.

Comments