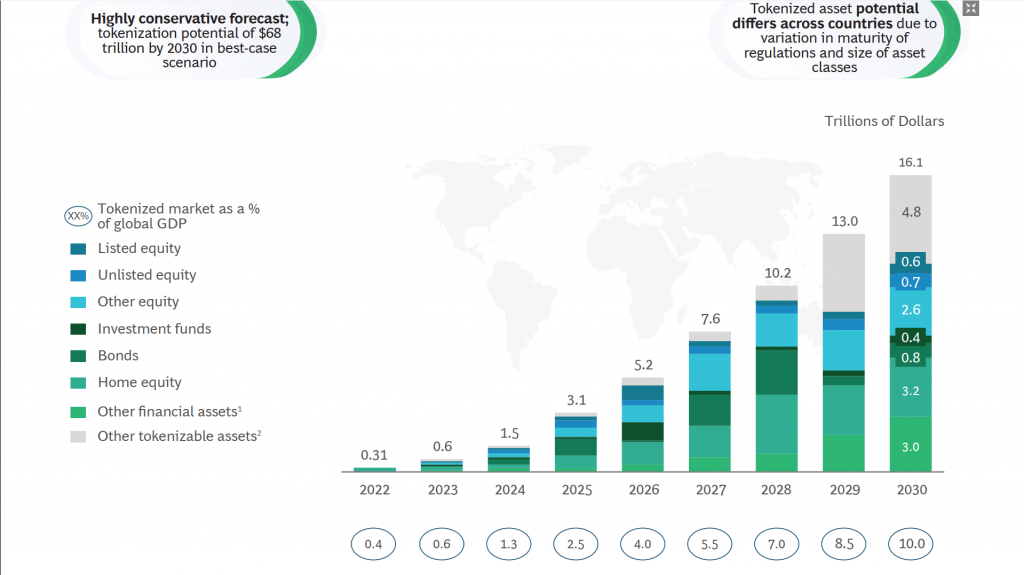

According to the World Economic Forum, in its Global Agenda Councils formulate a highly conservative prognosis, predicting that by 2030 tokenization could reach a market of more than 68 trillion dollars, i.e. without including cryptocurrencies.As noted in the following table, the estimated growth of goods and services offered under this technological format is doubled year after year. A process already initiated that large investment funds and international financial institutions began to evaluate, taking positions and making mid-term bets.Even Larry Fink, CEO of Blackrock, one of the world's leading investment managers, has leaked that the new generation of financial instruments or securities will be through tokenization. The term tokenomics arises from the union of two words, token and economy.

The term tokenomics arises from the union of two words, token and economy.

What are tokens?

Before the appearance of cryptocurrencies were identified as token a any non-dial representation that could mean a score or value within a closed and private environment. For example, some entertainment games chips have this denomination, as well as the fairs or kermesse prizes exchanged for teddy or other type of chucherias.However, from the onset of bitcoin to date, the tokens are a key part of the new economy, as all Cryptocurrencies constitute representations that, for some people, mean value. Hence token, cryptocurrency or digital asset are expressions, which, despite having differences, share similar features and representations.Within the classification of tokens defined as cryptocurrencies exist:- original encryptions, category reserved for two pioneers and more recognized, as much as its diffusion as the volumen and market participation, bitcoin and ethereum.

- altcoins, which group all other later projects, which have emission protocols and own algorithms, which are listed in the exchange panels or cryptocurrency markets.

- Tokens That is what we are talking about. use protocols of other species previous to generate independent registry environments to the emission rules on which they were designed, i.e. they can use the emission logic of an original crypto or any other altcoin to represent a different value.

- stablecoins, are tokens that have a traditional support asset, i.e., although it is a digital asset, which is represented and transacts in the same environment that a cryptocurrency exists as well as support. In summary, stablecoins represent a digital record of something else, whose The main objective is to simplify the processes of access, transaction and fractionation of the underlying representative or asset..

Why economics?

When referring to “economy of a token” they consider what they would be the reasons why someone would value you to this digital representation that is intended to offer.Undoubtedly, supply and demand are one of the fundamental paradigms to define the price of anything.In this sense, the different proposals apply to the most varied rules that can affect the price of these representations, in order to review:- Quantity. The amount is a key factor in time to speculate with the value of something. In understanding that the less valuable, any digital asset should take into account this attribute.

- Inflation or deflation policy. There are proposals that contemplate the realization of periodic emissions that increase the base offered, whereas on the contrary, there are others that raise start with a larger initial stock so that then, based on certain events, as may be the course of time or use, reducing supply.

- Self-regulation mechanisms of supply and demand. In some cases, the emission rules predict that, due to the low price of the digital asset in question, the algorithm automatically reduces the offer, “having” part of the emission to reduce the offer and thus try to increase its quote.

- Tokens defi. A new world of protocols based on cryptocurrencies whose goal is to reproduce the functions of the traditional financial system (weapons, savings, insurance and exchanges). These protocols emit tokens that perform a wide variety of functions, but that can also be eaten with them or preserved as any other cryptocurrency.

- Control tokens. These specialised DeFi Tokens provide those who have the ability to vote in the future of a protocol or an application which, when decentralized, do not have a joint directive or another central authority.

- Non fungible tokens (NFT).The NFTs represent the property rights of a single digital or real asset. It can be used to be harder to copy or share a digital creation. They were also used to issue a limited amount of digital artwork or sell unique virtual assets as uncommon objects in a video game.

- Tokens of value securities. Value securities tokens are a new class of assets whose goal is to be the equivalent, in crypto environment, of traditional assets such as actions and obligations. Its main use is to represent ownership rights over traditional, physical or intangible assets, without the need to have a corridor. There are numerous projects in evaluation to be launched in the short term using this form of fundraising, decentralized record of the tenences and transactional environment for their operations.

Other key issues to take into account when analyzing tokens and their tokenomics are:

- El Salvador Superiority of the issuer. Obviously, if those who offer the market a digital asset have a background of solvency and adequacy, particularly with regard to the object of the right that is tokenized greater confidence and acceptance will have among potential acquirers and investors.

- The title underlying asset support Whether it's an algorithm or a title of ownership. The legal aspects of the domain or ownership of goods or services affecting tokenization also contribute to the acceptance and circulation of digital assets.

- The clarity of the trust and smart contract. In this sense, it is essential that the constituent instruments that give origen to the emission of a digital asset take into account the greatest amount of possible aspects that can affect their quantity, quality and value. These rules should be clear and defined both in the smart contracts that originate token and in the traditional fideicomises that could be part of the emission process.

- The laying agents, understanding how such to all organizations or companies that offer and commercialize tokens. In such cases, in addition to traditional financial agents (bag houses, banks or financial companies) can be added to the experts in the area of the underlying asset token, for example, if it is tokens related to real estate, real estate could be marketed, or for the case of cereals, grains or livestock, regional cooperatives, or farm rematators.

Comments