Starbucks, the famous coffee chain, has become a business success reference thanks to its innovative business model. Founded in Seattle in 1971, the brand was able to adapt to changes and evolve to stay at the top of the industry. From the beginning, Starbucks has focused on coffee quality and customer experience in its stores, but another of the great reasons for success is constant innovation. As in ‘70 was the idea of “the fast chain of coffee” that revolutionized the industry, this decade was the idea of offering a rewards card that allows customers to carry balance and use it in their stores, becoming what some called "the bank selling coffee".

Rewards card issued by Starbucks.

Rewards card issued by Starbucks.

The Starbucks Card

Today, the Starbucks card has become an indispensable tool for many frequent customers. With it, it is possible to recharge balance and use it to buy drinks, food and other products in any of the chain stores. In addition, one of the aggregated values that got this card is the information that you provide about each client, i.e. by being associated with a person who registers with your personal data, this offers a large capital of information to Starbucks. In this way, exclusive promotions can be segregated by age group, by geography and beyond. As if that were little, it generates a bond of loyalty to the consumer, since by using the card a lot, products from the Starbucks ecosystem are obtained free.

But, following the line, so far the above-mentioned benefits do not differ from a loyalty program or from a prepaid card of any other industry... So, What's the Starbucks card special?

Deposits without Interes

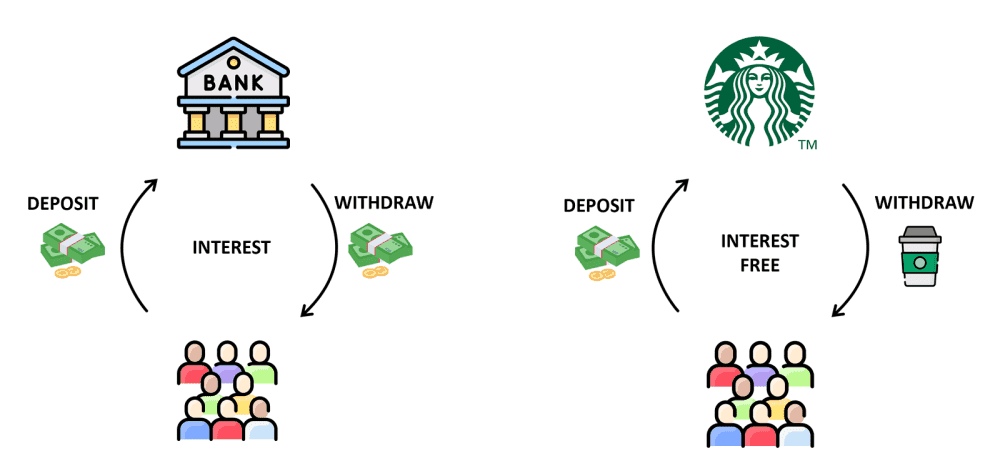

What makes the Starbucks card really innovative is that the company managed to become a bank without being a bank. Since the release of the card, Starbucks has managed to get its customers loans at zero rate, thanks to the confidence it generated with its loyalty program. This is the success of the card, which Starbucks reported in 2016 that under the wing of your card there were $1.2 billion in deposits from your customers. And to have a better reference, it has more money in deposits than most US banks and payment suppliers, with the small detail that the core of your business is coffee. But that's not the only thing, unlike a traditional bank, Starbucks doesn't pay its customers for their deposits, which is why they call it. “a loan from your customers at zero rate”. And not to be surprised, Starbucks reports that about 10% of the money stored on the cards is pure gain because their customers forget forever.

Comparison of the Starbucks model against a traditional bank.

Comparison of the Starbucks model against a traditional bank.

The achievements obtained by Starbucks from this measure are impressive. The card allowed the company to increase its loyal customer base thanks to the possibility of obtaining exclusive discounts and promotions. In addition, it improved customer experience by allowing you to load balance and use it easily and conveniently in your stores. It gained a greater understanding of its consumers, gathering information about their preferences, as well as the frequency of their visits to the stores, and, not least, managed to capitalize in a very intelligent way.

In conclusion, Starbucks has proven to be an innovative company that has known to historically adapt to market changes. The card was one of the company's most successful measures (and the most successful loyalty programs in the world), allowing it to become a bank without being a bank and offering additional benefits to its customers. The strategy generated a solid foundation of loyal customers and improved customer experience in Starbucks stores. That is why we can say that Starbucks is a bank selling coffee.

Comments