The blue dollar quote has become a central topic in the Argentine economy, especially in a context of high inflation and exchange rate volatility. Why is it crucial to understand its current dynamics? The blue dollar, which operates in the informal market, reflects distrust in the formal economic system and has deep implications for fiscal policy, investment, and citizens' purchasing power. In this analysis, we will explore the current situation, underlying causes, international comparisons, and the consequences this quote has for Argentina.

📈 Current Situation and Context

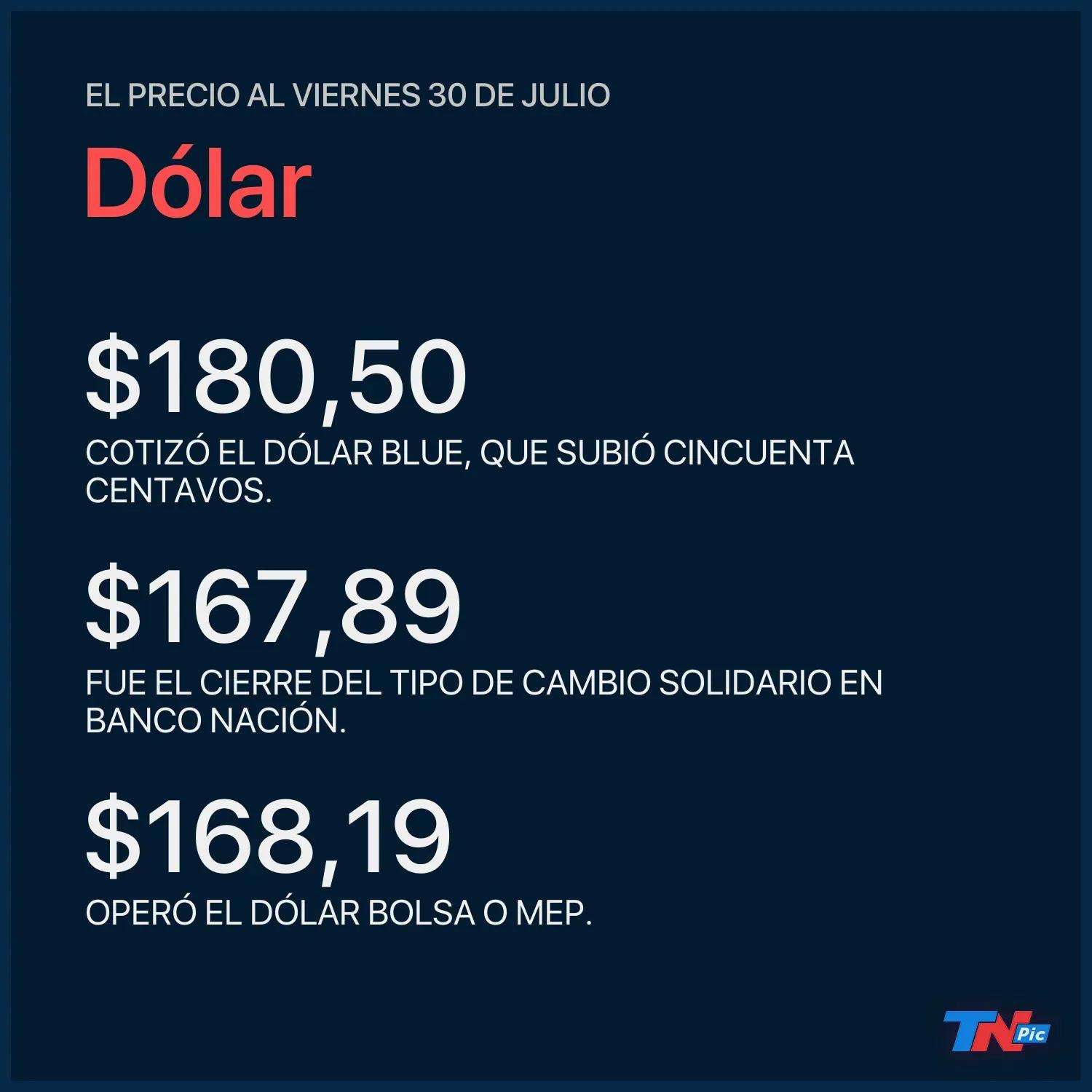

In recent days, the blue dollar has reached a quote of $1,540 for sale according to reports from specialized media. This figure represents a significant increase compared to the $1,510 recorded just a week ago. The variability of the exchange rate reflects the economic uncertainty faced by Argentina, where annual inflation exceeds 100%, according to data from INDEC. This phenomenon is exacerbated in a scenario where the Central Bank’s reserves continue to decrease, limiting its ability to stabilize the Argentine peso. The blue dollar quote is not only an economic indicator; it is also a social thermometer that measures citizens' confidence in their currency.

🔍 Analysis of Causes and Factors

The increase in the blue dollar quote can be attributed to multiple interrelated factors. Firstly, the lack of confidence in the government's economic policies has led citizens to seek refuge in foreign currencies as a means to protect their assets. Historically, Argentina has experienced similar episodes; for example, during the economic crisis of 2001-2002, there was a massive flight towards the dollar. Additionally, currency restrictions imposed by the government have limited access to the official foreign exchange market, fostering the growth of the parallel market.

Another important factor is persistent inflation. According to projections from the International Monetary Fund (IMF), Argentine inflation is expected to reach figures close to 120% this year. This situation rapidly erodes citizens' purchasing power and reinforces the demand for dollars as a means to preserve value. In summary, the current economic context is marked by a lethal combination of institutional distrust and inflationary pressure that fuels speculation about the future of the peso.

🌍 International Comparison and Global Impact

To better understand the situation of the blue dollar in Argentina, it is useful to compare it with other countries that have faced similar currency crises. For example, in Venezuela, where the bolívar has suffered extreme depreciation due to ineffective economic policies and systemic corruption, the parallel exchange rate has become more than 10 times higher than the official rate. This phenomenon is also observed in Turkey; there, after multiple economic crises and erratic political choices, the Turkish lira dramatically fell against the dollar.

The international lessons are clear: without strong institutions and responsible fiscal policies, there is no trust. Without trust, there is no investment or sustainable economic stability. Argentina must learn from these precedents to avoid falling further into a destructive cycle that compromises its future development.

⚖️ Implications and Consequences

The implications of the increase in the blue dollar are multiple and affect various economic and social sectors. Firstly, it directly impacts the prices of goods and services as many companies adjust their costs considering a higher exchange rate. This further fuels inflation and generates a vicious cycle that is difficult to break.

Additionally, this situation negatively affects potential foreign investors; if they perceive an unstable environment where rules change constantly, they will reduce their participation or withdraw existing capital. This further limits sustainable economic development opportunities for Argentina.

On the other hand, citizens face increasing difficulty accessing basic products due to the constant rise in prices resulting from exchange rate fluctuations. In this sense, it is observed how social tensions can increase when the most vulnerable sectors see their real incomes eroded.

🚀 Strategic Perspective and Future Outlook

Looking ahead, it is essential to adopt comprehensive strategies to address this complex issue. One possible solution would be to implement structural reforms that strengthen economic institutions and promote a solid fiscal framework that generates trust both nationally and internationally.

It is imperative to establish more flexible exchange rate policies that allow a balance between the official and informal markets without generating significant distortions. In the long term, Argentina needs to foster an environment conducive to attracting sustainable investments that contribute to real economic growth.

In conclusion, although the immediate outlook seems grim regarding the blue dollar quote and its collateral effects on the Argentine economy, opportunities exist if adequate strategic measures are adopted based on successful international experiences. Time is of the essence; Argentina does not need more patches; it needs a clear course towards lasting stability.

Comments