Have you ever felt like your money evaporates before the end of the month? This course is your opportunity to transform your relationship with money with the help of an expert who knows exactly what they're talking about.

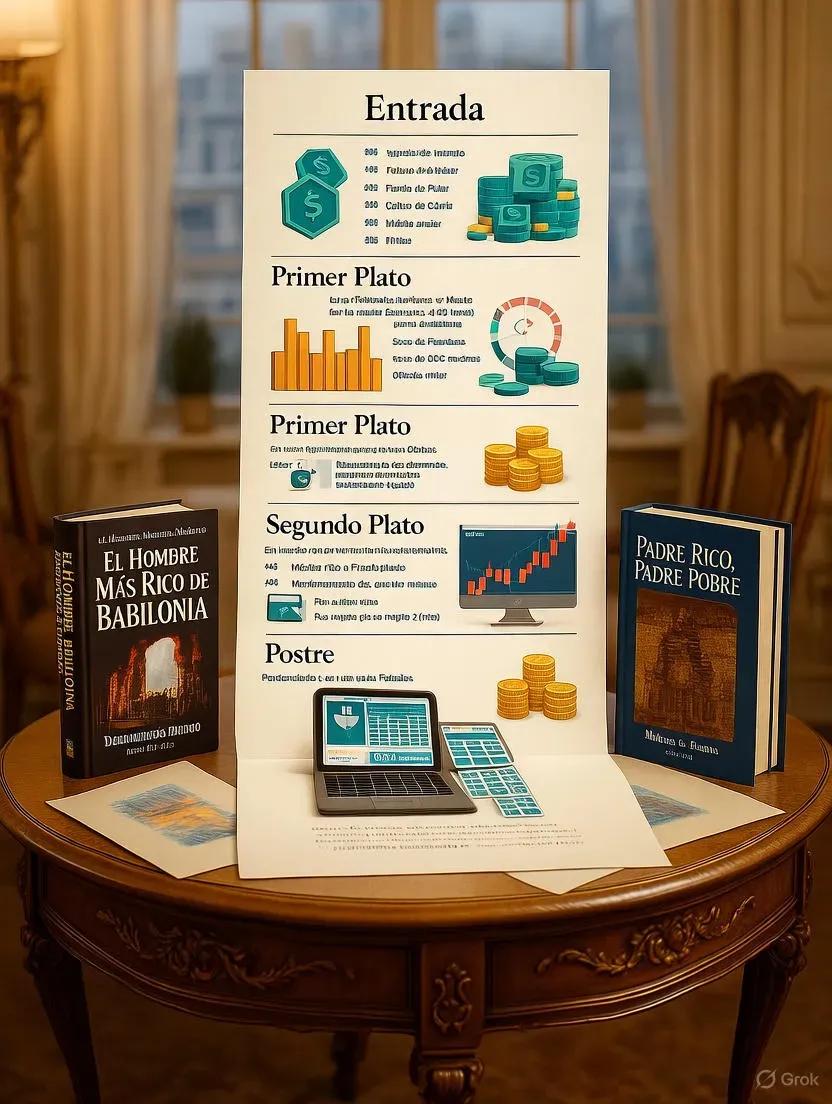

Damián Di Pace (ig: damiandipace), a recognized economist, investor, and journalist specializing in finance, has designed a unique program that simplifies the complex world of savings and investments into an easily digestible menu. With his vast experience in the financial market and his ability to communicate economic concepts accessibly, Di Pace will guide you step by step from your first savings to advanced investment strategies. The dynamic he proposes as savings is divided into four stages, which are: Appetizer, main dish, second course, and dessert.

Module 1 - Appetizer: The Fundamentals of Saving

The journey begins with the most important step: learning to save. In this first module, you will discover the most effective techniques to build your financial cushion, exploring everything from traditional cash methods to modern options like digital transfers and even cryptocurrencies.

Di Pace presents his 4-step methodology, specifically designed for you to implement it regardless of your current income level. You will learn to identify where and how to invest your savings, get to know the most reliable platforms in the market, and develop the criteria necessary to make decisions like a true investor.

This module introduces us to the 50-30-20 rule, a proven formula that will transform the way you manage your money: allocate 50% of your income or salary to essential expenses and debts, 30% to personal pleasures, and reserve 20% for investments or an emergency fund. Simple, effective, and sustainable over time.

Module 2 - First Course: Delving into Investment

With the foundations of saving established, it’s time to take the next step. This module opens the doors to the fascinating world of investments, aiming to dispel myths and doubts.

You will explore the different investment alternatives available: from the classic dollarization of your assets to Mutual Investment Funds (FCI) that allow you to diversify without being an expert, to the revolutionary cryptocurrencies. You will also discover opportunities in real estate and understand how bonds work and their different types so you can choose the option that best fits your risk profile and financial objectives.

Module 3 - Second Course: Mastering Digital Investment Channels

Technology has revolutionized the way we manage our money, and this module prepares you to navigate the digital financial ecosystem with confidence.

You will delve into the universe of blockchain technology that underpins it, understand how it relates to virtual wallets through various transactions, new technologies like NFC, and how digital loans work. You will learn to identify trustworthy wallets backed by the National Securities Commission (CNV), so you can operate with complete security and peace of mind.

Module 4 - Dessert: High-Level Recommendations

As the icing on the cake, Di Pace shares his most updated recommendations and advanced strategies for those looking to diversify and enhance their investment portfolio.

For classic investors, you will also discover opportunities in minerals and precious metals, understand why energy companies, lithium mining companies, and banks with high capitalization can be smart bets in our country. You will also explore the real estate market from a professional perspective, analyzing investments per square meter and through specialized companies, in addition to diving into the dynamic stock market.

As an invaluable bonus, the course includes a carefully selected bibliography with essential titles such as "The Richest Man in Babylon" (recommended for any financial level), "Rich Dad Poor Dad", "The Intelligent Investor" by Benjamin Graham, "Toxic Habits", and "The Art of Starting" along with its version 2.0, so you can continue your financial education beyond the course.

Module 5 - Assessment: Test Your Learning

The course culminates in a questionnaire designed to consolidate everything learned, allowing you to identify your strengths and areas of opportunity on your new path as a conscious investor.

From the first module to the final recommendations, each "course" of this economic menu is designed for you to progressively build your financial intelligence, whether you're starting from scratch or already have experience and seek to refine your strategies.

The question is not if you can afford to take this course, but if you can afford not to.

Comments