José Noguera Santaella from El Nudo Gordiano for Poder & Dinero and FinGurú

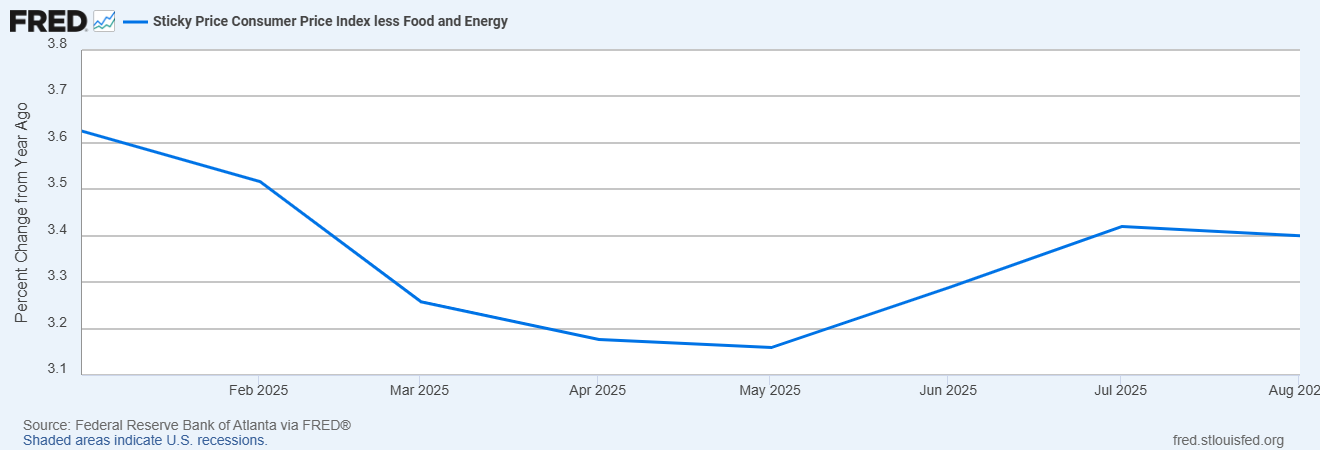

The U.S. economy is showing signs of heading towards stagflation, an atypical situation, rarely occurring, where both the inflation rate and the unemployment rate increase simultaneously. The following graphs show the trend. First, observe the inflation rate of the Consumer Price Index, which consists of the typical basket consumed by American families.

The inflation rate, which had been on a downward trend since last year, resumed its upward trend again starting in May of this year, after President Trump announced the imposition of tariffs on all countries in the world.

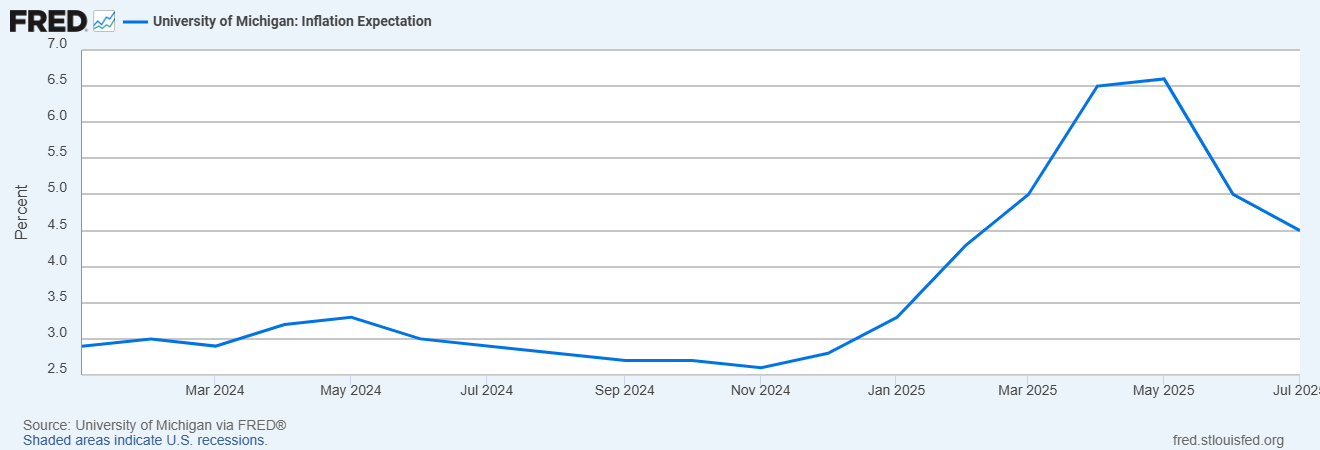

Although the imposition of tariffs has taken time to be implemented, the mere announcement creates inflation expectations that economic agents, both families and businesses, immediately begin to take into account, a fact that alone generates inflation, as businesses, anticipating higher price levels, raise their prices thinking that when the time comes to replenish their inventories, they will have to pay higher prices. Indeed, the following graph, which shows the inflation expectations index prepared by the University of Michigan, clearly shows how the inflation expectations of the population have been drastically increasing since Donald Trump took office in January 2025.

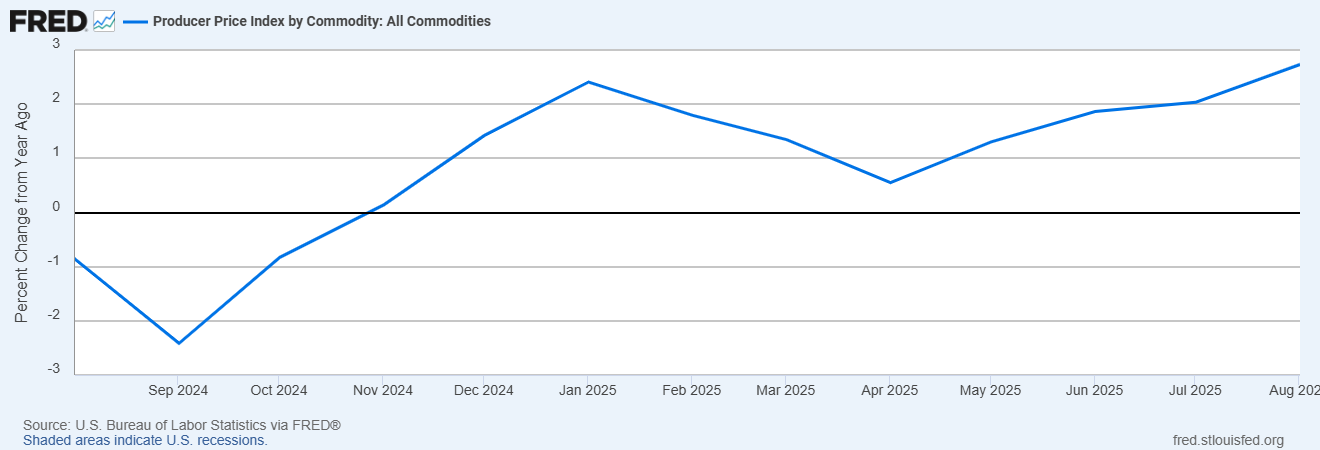

These expectations would be justified if, as is indeed occurring, the prices businesses pay for the products they purchase to operate are increasing. This is precisely what is observed in the following graph, with the upward trend of the producer price index.

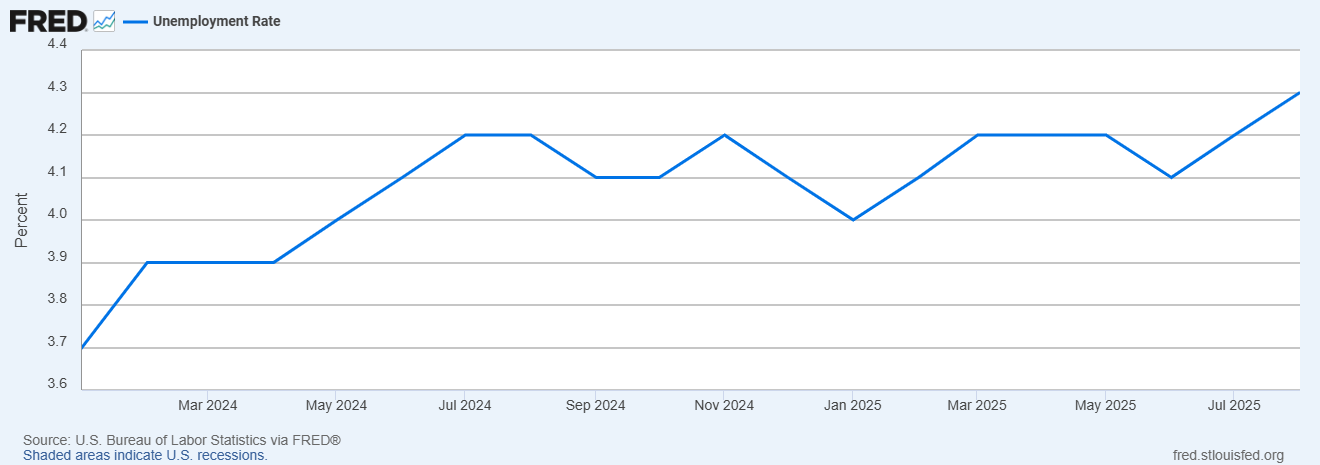

To curb a resurgence of inflation, the Fed had not lowered interest rates until now, when the symptoms of recession are becoming increasingly evident. The following graph shows the trajectory of the unemployment rate over the past two years:

Although alarming levels of unemployment are not yet shown, the Federal Reserve decided to lower the interest rate, something President Trump had been pressuring for, to the point of threatening to illegally fire the Fed's Chairman, Jeremy Powell, and the Fed Governor, Lisa Cook.

The question many are asking is whether the Fed's decision is related to pressures from President Trump, or if it is a legitimate concern to curb the rising inflation rate. The decision is relevant for future inflation, and perhaps the economic performance of the next decade will be conditioned by these pressures, during a period that would last well beyond Donald Trump's presidency.

The problem is that inflation is a very tricky variable. The point is that, regardless of the inflation rate, the unemployment rate will always return to its full employment level. So, if the reduction in inflation rates is due to a legitimate effort by the Fed to decrease the unemployment rate, but economic agents perceive that the Federal Reserve remains committed to a target inflation rate of 2%, agents will maintain their long-term expectations at that level and eventually employment will return to its level of full employment with that low inflation rate.

However, if the signal that economic agents eventually receive is that the Federal Reserve is yielding to pressures from President Trump, it is because it wants to generate employment and eventually set the inflation rate at a permanently higher level, something that sooner or later economic agents, families, and businesses will perceive and begin to adjust their purchasing patterns according to the new permanent level of high inflation.

The last time something like this happened was during Richard Nixon's presidency when the then-Fed Chairman, Arthur F. Burns, starred in the famous episode of political pressures on monetary policy before the 1972 elections to help his friend Nixon win reelection, in an episode that lasted more than a decade and ended with the brutal anti-inflation adjustment at the beginning of the 1980s, long after Nixon had left the presidency, after James Carter's presidency and at the beginning of Ronald Reagan's term, when Paul Volcker was the Fed chairman.

Professor José Noguera-Santaella obtained his PhD in Economics from the State University of New York at Buffalo, after completing his undergraduate studies in Mathematics at the Central University of Venezuela. He has held positions at the National University of Kiev, the University of Warsaw, Michigan State University, the University of New Hampshire, and also at the Economic Research and Graduate Education Center - Institute of Economics, a joint work center of Charles University and the Institute of Economics of the Czech Academy of Sciences. He is currently a full professor at the University of Santiago de Chile, where he is the founding director of the graduate program in Economics. He has conducted extensive research on the oil market and macroeconomics, on which he has published several books and articles.

Comments