Breakdown of Trade Negotiations between the U.S. and Canada

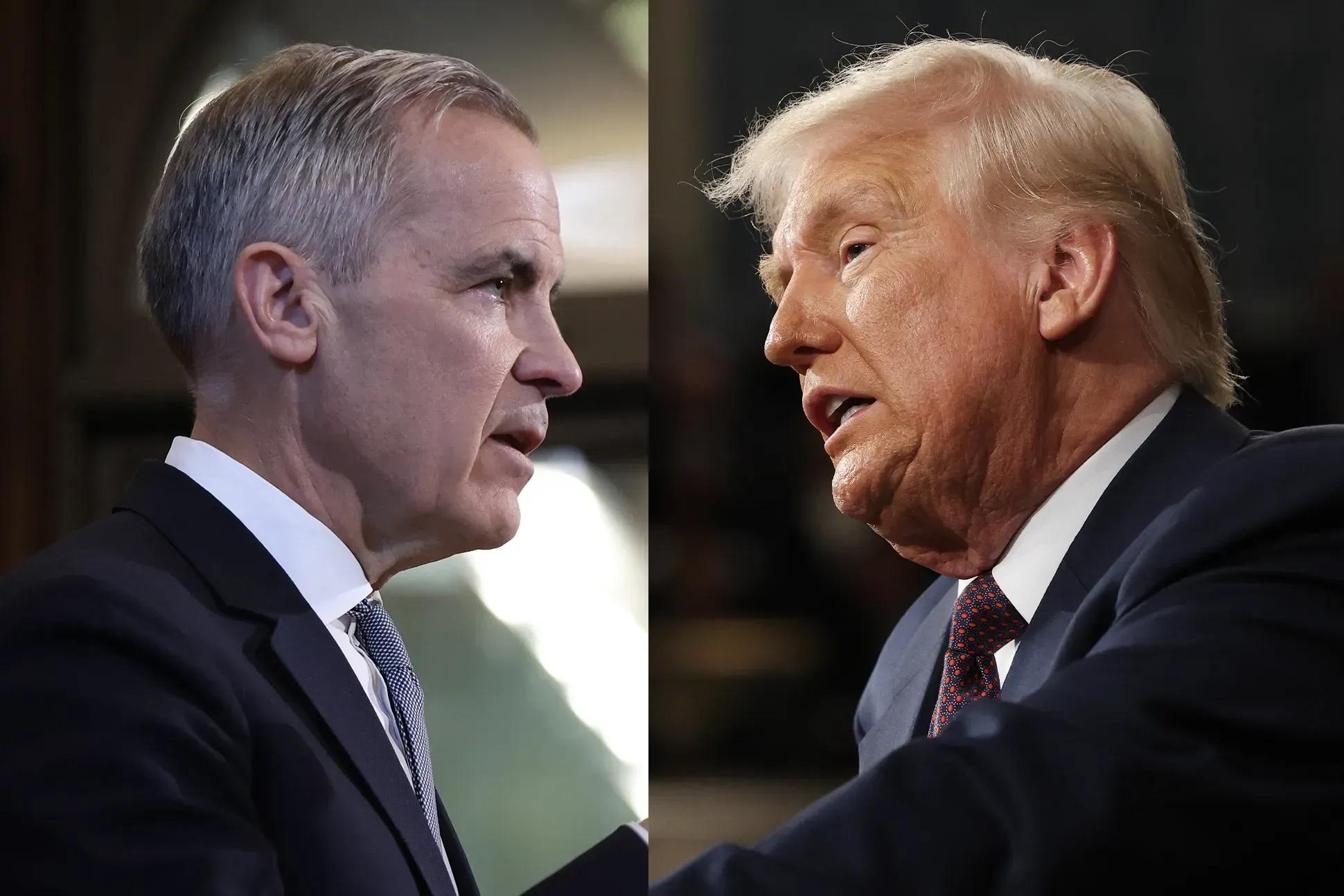

Washington, June 27, 2025. Former President Donald Trump unilaterally announced the complete breakdown of trade negotiations with Canada. The trigger was the entry into force of a 3% digital tax applied by the Canadian government to U.S. technology companies, including Amazon, Google, Meta, and Apple. The measure, retroactive since January 2022, was considered by Trump as an "unjustified tax attack" and an offense to bilateral trade.

The announcement was published directly on Truth Social:

“Based on this egregious Tax, we are hereby terminating ALL discussions on Trade with Canada, effective immediately.”

This message marked the abrupt end of months of technical dialogue under the Treaty between Mexico, the United States, and Canada (T-MEC/USMCA). The Trump administration also criticized old Canadian tariffs on U.S. products, particularly those related to the dairy, steel, aluminum, and automotive sectors. Additionally, it is preparing new retaliatory measures estimated at $2 billion, invoking Section 301 of the United States Trade Code.

Political Context and Canada's Reaction

From Ottawa, the official response was moderate. Prime Minister Mark Carney called for calm and dialogue, although he reaffirmed his country's fiscal sovereignty. Finance Minister François-Philippe Champagne stated that the digital tax is part of a broader policy aimed at adapting taxation to the digital economic model. During his campaign in March, Carney had taken a harsher tone:

“He wants to break us so America can own us… We will not let that happen.”

The Canadian DST (Digital Services Tax) fits into a global trend driven by the OECD. Various countries are beginning to require large technology companies to pay taxes based on the income they generate locally, regardless of whether they have a physical presence in that country. Despite this multilateral context, the United States has reacted firmly, considering that the measure directly targets its companies.

Immediate Impacts and Key Figures

The decision is already generating effects in both economies:

Over 1,000 layoffs have been reported in the Canadian metallurgical sector.

It is estimated that 23,000 jobs in steel and 9,500 in aluminum are at direct risk.

In 2024, bilateral trade in goods between the U.S. and Canada exceeded $762 billion.

The U.S. trade deficit with Canada in goods was $63.3 billion.

More than 80% of Canadian exports are destined for the United States.

Nearly $98 billion annually crosses the Ambassador Bridge, a key point for automotive and agri-food supply chains.

The possibility that the United States would double tariffs on Canadian steel and aluminum up to 50% represents a severe blow to the integrated industries of the northern continent. Meanwhile, over 1.4 million jobs in the United States depend directly on trade with Canada. This raises concerns among unions, business chambers, and state governors.

Expert Reactions and Economic Analysis

Expert voices agree that this trade escalation is part of a deliberate political strategy by Trump, rather than an impulsive reaction. Political scientist Daniel Béland (McGill University) noted:

“The Digital Services Tax was approved a year ago, so its implementation was predictable. Trump chose this moment to generate drama amid uncertain negotiations.”

From an economic standpoint, Michael Pearce (Oxford Economics) warned that the announcement generated instability in the markets and could hinder investor optimism, especially in the technology sectors. For Kenny Polcari, strategist at SlateStone Wealth, “markets seek certainty in trade” and this breakdown increases the risk of regional slowdown.

Analyst Ian Lee believes that Trump is using tariffs as a coercive tool, a lever to force concessions without reciprocal commitments. Meanwhile, former economic advisor Stephen Moore criticized the approach, warning that such policies could create “a very unstable economy” if trade disputes escalate with Canada, Mexico, and China.

Future Projections: A New North American Trade War?

The rupture of talks not only threatens traditional sectors such as dairy or metallurgy. It could also extend to emerging sectors like digital services, automation, semiconductors, and renewable energy, where the U.S. and Canada had begun coordinating standards and shared production.

The conflict also tests the solidity of the T-MEC, an agreement that replaced NAFTA and that until now was considered key for regional trade stability. If the United States decides to operate outside the multilateral framework and intensify sanctions, it would create a structural rift in North American economic cooperation.

Comments