For many years, Argentina's agricultural sectors have faced adverse economic ecosystems, managing crop, grain and livestock production under challenging climatic and economic conditions. However, Argentine producers have stood out not only for their resilience in the face of these adversities, but also for their ability to position themselves among the world's top ten food exporters in various sectors.

Today Argentina is facing a unique and unprecedented global scenario. This context is marked by political, economic and social crises in the main world economic powers. For example, China, a historical buyer of products such as Argentine beef, is implementing tariff policies similar to those of the United States, seeking to impose its own trade rules.

On the other hand , although not directly linked only to the agricultural sector, the U.S. public debt reached historically high levels in 2024, with a projected increase that could affect all economic sectors, including agriculture. It is mentioned that public debt could reach 122% of GDP by 2034 without changes in fiscal policy, implying continued pressure on the resources available to the sector.

Regarding the U.S. cattle inventory, this past year it reached critical levels where a 2% decrease in the cattle inventory was estimated, reaching 87.2 million head as of January 1, 2024, which significantly affected production projections and, therefore, economic expectations for the sector.

According to insurance companies, the drought in 2024 could cause economic losses for more than 50% of farmers and ranchers. Farmers and ranchers can be indemnified up to 80% of the value of their livestock or crops, but less than 50% of agricultural entrepreneurs are insured, which implies a large potential loss for those without coverage. This change in the international landscape opens a window of opportunity for Argentina, especially in terms of communication and export strategy.

Competitiveness and Regulatory Framework

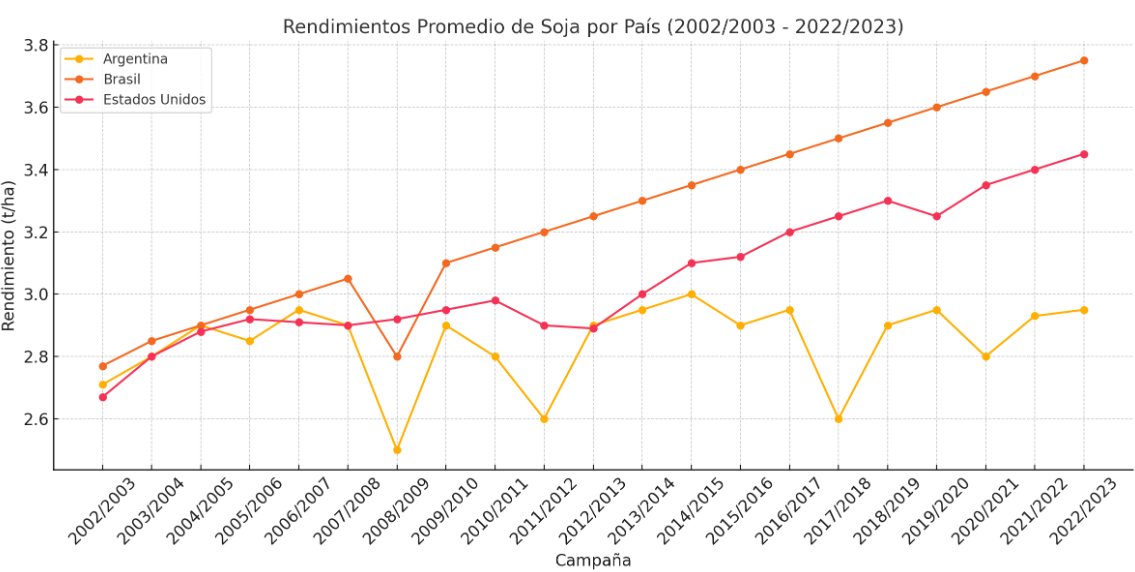

While it is true that Argentina is lagging far behind Brazil and the United States in terms of yields, our country has a strategic advantage in the biotechnology field thanks to its advanced regulatory framework for gene editing.

Without listening to them, I can already hear more than one person saying: "But Maggie, the United States does not have any taxes, besides, gene editing has been going on for years and they have a whole arsenal of biotechnology companies in Boston to recover and maintain their leadership".

Yes, that's true. But... as a good black sheep, I am going to question these statements.

Today, the biotech sector in the United States, both in the field and in healthcare, is being affected by two cross-cutting conflicts: 1. the rising costs and 2. the uncertainty regarding the future of the regulatory framework. Today the entire sector is witnessing a level of uncertainty never seen before, mainly because it is not known what position the regulatory bodies are going to take with respect to: crops, if they are going to allow genetic editing tools, if they are going to be more or less regulated, if they are going to encourage organic crops over edited crops, etc. etc. etc. The same applies for the health scheme with vaccines, drugs, telemedicine, etc.

This results in capital allocation (within the United States) being put on hold, especially for those investments considered new or riskier. In the same line, the sustained increase in costs and the heavy regulatory regime makes the continuous flow of innovation impossible, both in terms of crops and pharmacology, making this the dream opportunity for Argentine producers.

Argentina has a regulatory framework that allows for a faster and more efficient adoption of agricultural biotechnology technologies, in contrast to the stricter regulation in countries such as the United States. This regulatory advantage not only facilitates research and development but also positions Argentina as an attractive destination for biotechnology investments. The approval of genetically modified soybeans for agro-industrial processing, without authorization for planting, reflects how Argentina is taking advantage of its legal framework to innovate and export high value-added products (please do not take the Bioceres fiasco in the stock market as an indicator of Argentina's potential in the agricultural world, thank you).

The transgenic seed market in the United States, which is projected to reach USD 29 Bns by 2030, shows significant growth thanks to the adoption of genetically modified crops such as corn, soybean and cotton. Argentina could benefit from this market by exporting seeds in response to the growing demand for organic products in the United States.

The incorporation of technology into exports has the potential to transform Argentina's economic impact on the global market. The country already stands out as a leading agri-food exporter, and the adoption of advanced technologies can further increase its competitiveness. According to the World Bank, Argentina's agricultural sector represents 15.7% of GDP and 10.6% of tax revenues, with strong potential to grow if access to global markets is improved.

Strategic Communication

As we mentioned in our article: "The Strange World of Biotechnology: The Price of Ignorance" (Link: https://fin.guru/es/tecnologia-e-innovacion/hoy-en-el-extrano-mundo-de-biotecnologia-el-precio-de-la-ignorancia: ) the reason why Argentina is not integrated or associated in a more efficient way with the main development hubs such as the United States, was merely for the convenience of local groups and investment funds that benefited during the last decade from a closed scheme, with little competitiveness (what in informal vocabulary is called: "They got used to hunting in the zoo") vs. going out to build strong, competitive partnerships, scale them up and reposition Argentine producers in the world trade map.

While this may sound counterintuitive at first glance, the fact is that the level of product competition in the United States is much higher, both on the East and West coasts, than in the rest of Latin America. The technological advancement, the insatiable striving for innovation and the ability to absorb risk in the US is diametrically different from any wild aspirations that local funds in Argentina may have wanted to expose themselves to. Simply put, not only did they never understand the problems of entrepreneurship and the foreign market beyond Sillicon Valley, but they were also unwilling to build competitive companies, and the empirical evidence shows it. If this had not been the case, then:

1. local investment funds would have been the first to communicate more than a decade ago the multiple benefits of Argentina's regulatory framework vs. the American one and, indeed, they did not.

2. Given that Argentina has an undisputed potential, it should be very easy for them to name 15 cases of successful companies in the field of biotechnology, agriculture and/or health. I challenge you to name 10, in the field and/or health, that are public and successful.

.......

2025, New Chapter

In closing, we are facing a decisive moment that requires abandoning traditional paradigms to embrace a prospective and realistic vision, where the Argentine producer faces a historic opportunity. Argentina has the potential to consolidate its position as a global leader in advanced technological agriculture, supported by a cutting-edge regulatory framework that is already in place. The strategic communication of these capabilities will not only boost exports, but will also attract investments that are crucial for sustainable economic development.

The challenge ahead is as promising as it is demanding: to build and project a narrative that positions Argentina as the strategic partner par excellence in the global agribusiness scenario. This is not simply an aspirational objective, but an achievable goal that requires commitment, strategic vision and effective communication. The future of Argentine agriculture lies not only in the quality of its production, but also in its ability to communicate its value to the world in a clear, convincing and sustained manner. The time to act is now, and the potential for transformation lies in deciding whether to stay in the past or to hold on to the future.

.

Comments